Loan Application Tracker

Track Every Loan Application From Submission to Disbursal

Simple portal for tracking approvals.

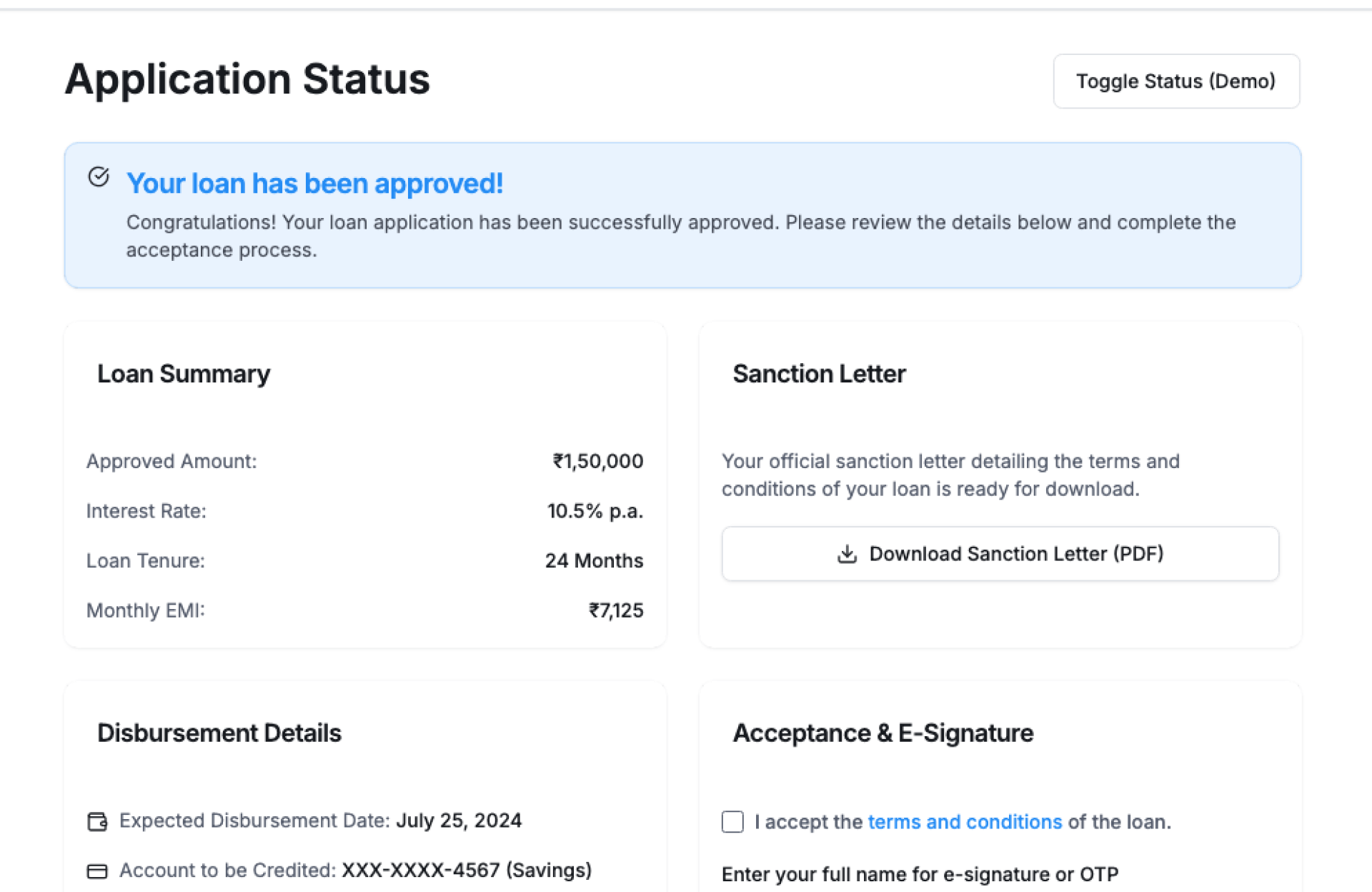

See Loan Application Tracker In Action

The Loan Application Tracker by Kriatix gives lenders and finance teams complete visibility into the loan lifecycle. From application intake to approval and disbursal, it centralizes status, documents, and milestones so nothing gets delayed or lost.

Built for growing loan volumes, it brings transparency, speed, and control to loan operations.

🔹 Start Free Trial

🔹 Book a Demo

🔹 Request Pricing

What Is the Loan Application Tracker?

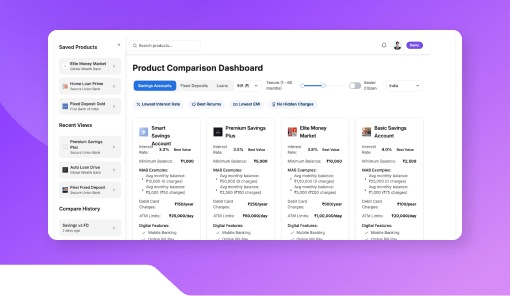

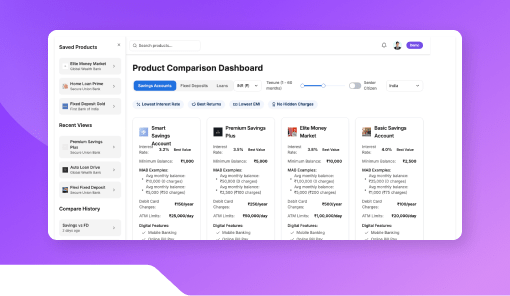

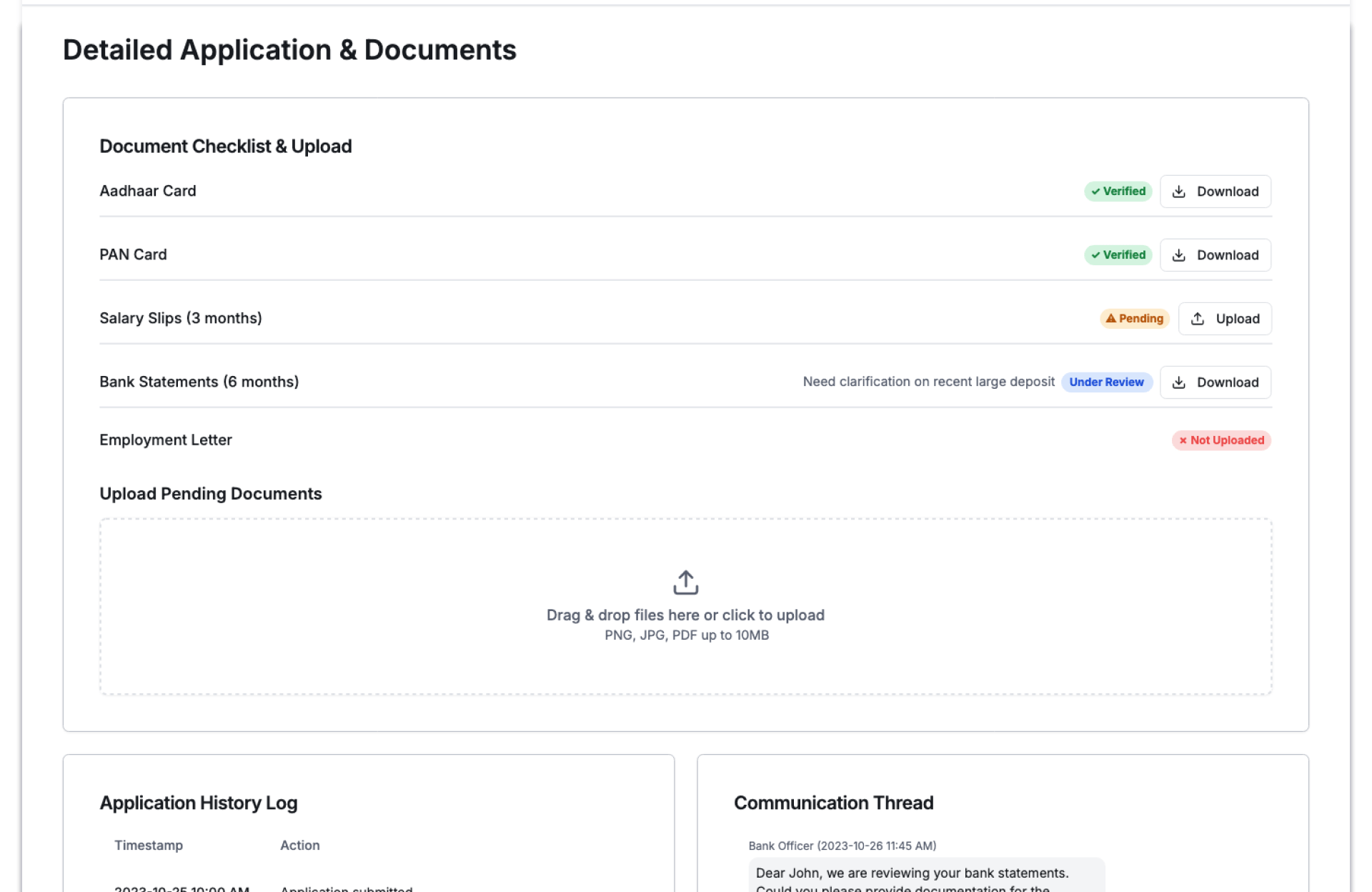

The Loan Application Tracker is a configurable system that monitors loan applications across stages such as submission, verification, approval, and disbursal. It consolidates applicant data, documents, and status updates into a single dashboard, enabling teams to act faster and communicate clearly.

It adapts to different loan products, approval flows, and compliance needs.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Lending Teams | Track applications without manual follow-ups |

| Credit & Risk Teams | Monitor verification and approval stages |

| Operations Teams | Identify bottlenecks in loan processing |

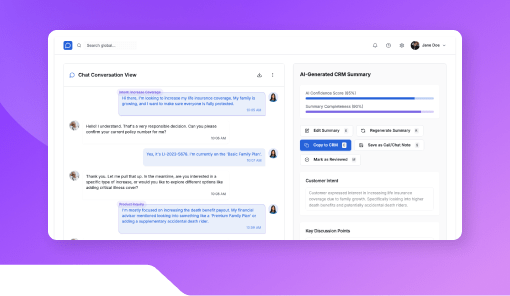

| Customer Support Teams | Answer applicant status queries instantly |

| Founders & CXOs | Get a real-time view of loan pipeline health |

Key Features

- End-to-end loan application tracking

- Configurable loan stages and workflows

- Applicant profile and document visibility

- Status updates and milestone timelines

- Exception and delay alerts

- Search and filter by product, status, or date

- Export-ready reports for audits and reviews

Benefits

- Reduce loan processing turnaround time

- Eliminate manual status tracking

- Improve applicant communication and trust

- Increase operational efficiency

- Gain clarity into approval bottlenecks

- Support compliance and reporting needs

How It Works

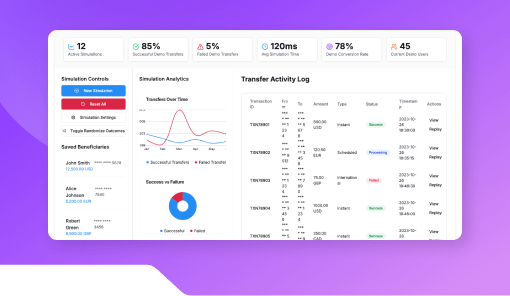

- Capture Applications – Ingest loan requests and applicant data

- Define Workflow Stages – Configure steps for each loan type

- Track Progress – Monitor applications across all stages

- Flag Delays – Identify exceptions and stalled cases

- Report & Analyze – Review pipeline performance and outcomes

Add-ons & Integrations

- Credit Assessment & Risk Scoring

- Document Verification Module

- Payment Reminder Bot

- Finance Analytics Dashboard

- API access for core lending systems

Deployment & Access

- Web-based interface

- Cloud or on-premise deployment

- Secure data handling and audit trails

- Role-based access and permissions

What Our Partners Are Saying

Frequently Asked Questions

Can this handle multiple loan products?

Yes. Workflows can be configured for personal, business, or custom loan types.

Does it support document tracking?

Yes. Applicant documents and verification status can be tracked at each stage.

Can teams receive alerts for delays?

Yes. Alerts can be set for stalled or overdue applications.

Is historical loan data supported?

Yes. Past applications can be analyzed for performance and trends.

Can customer-facing teams check application status?

Yes. Role-based access allows support teams to view relevant status updates.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started