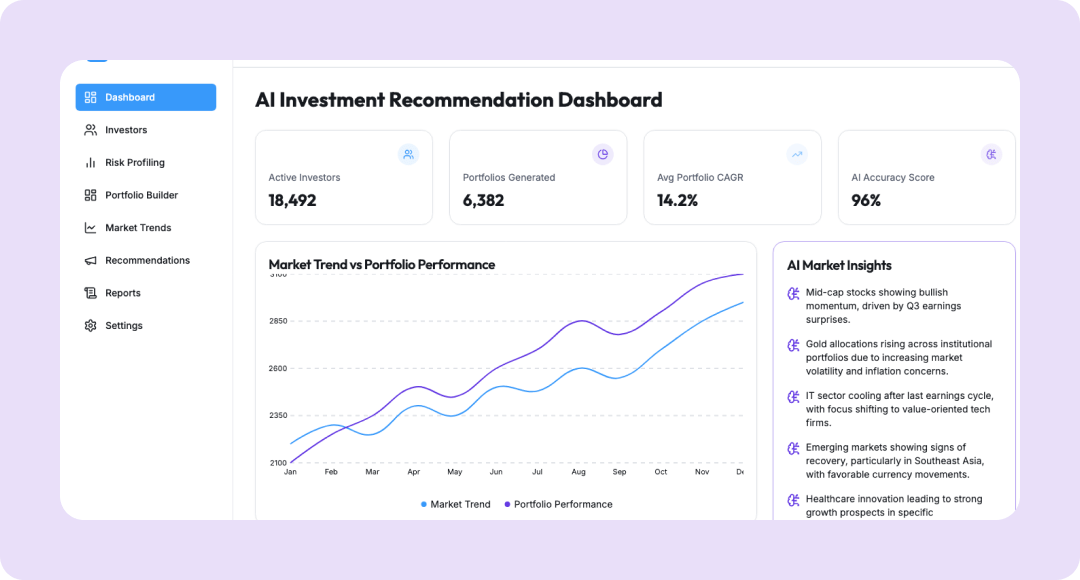

Investment Recommendation Bot

Deliver Personalized Investment Advice with AI Precision

Empower users to make smarter investment decisions through Kriatix’s AI-powered Investment Recommendation Bot — built for wealth platforms, robo-advisors, and digital brokers.

See Investment Recommendation Bot In Action

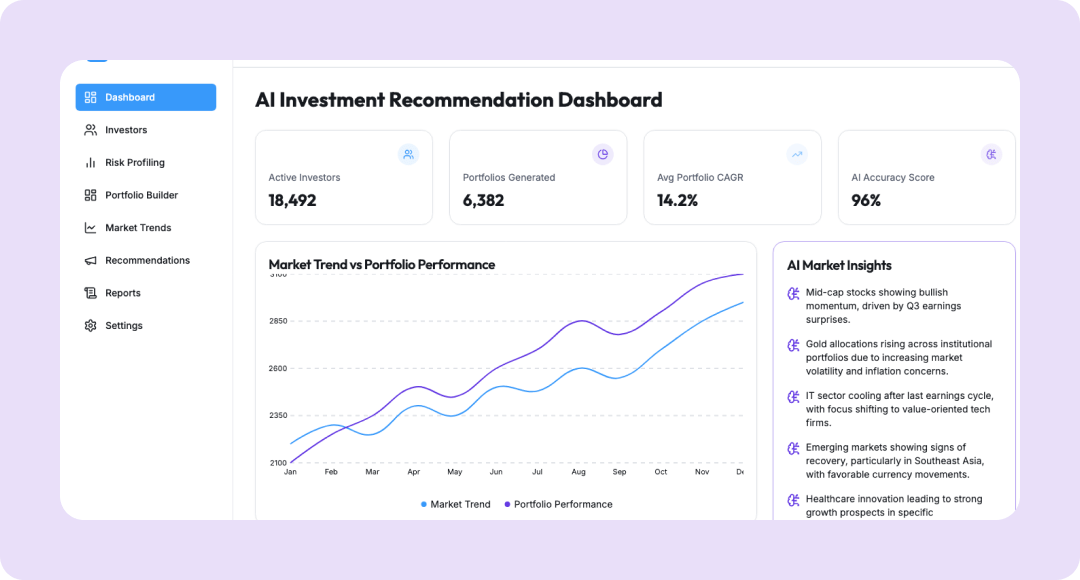

The Investment Recommendation Bot helps fintechs, wealth managers, and investment platforms personalize financial recommendations for each user. It evaluates parameters such as income, goals, risk appetite, and market conditions to suggest suitable portfolios, mutual funds, or asset allocations.Using AI and behavioral analytics, it ensures investors receive advice that’s personalized, compliant, and data-driven.

🔹 AI-driven portfolio and asset recommendations

🔹 Goal-based planning and real-time market alignment

🔹 Built-in risk and suitability scoring for compliance

What Is the Investment Recommendation Bot?

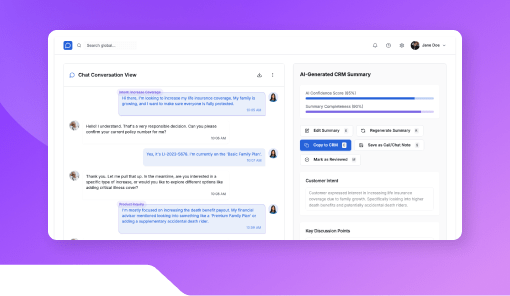

The Investment Recommendation Bot combines natural language understanding, recommendation models, and financial APIs to deliver hyper-personalized investment advice. Users interact conversationally, describing goals like “save ₹5L in 3 years”—and the bot responds with optimized investment strategies.

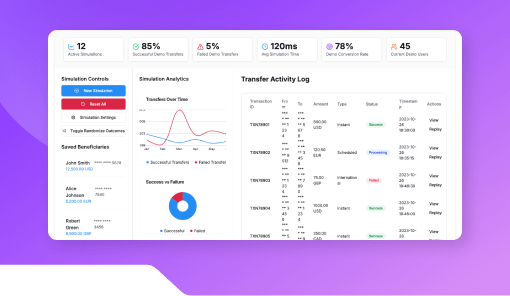

It can also rebalance portfolios dynamically based on market data and customer updates.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Wealth Managers | Offer automated, compliant advice to clients |

| FinTech Platforms | Add robo-advisory capabilities without custom AI builds |

| Retail Investors | Receive personalized, goal-based investment plans |

| Brokers/Advisors | Scale advisory services with AI co-pilot support |

| CXOs / Product Heads | Increase platform stickiness and customer lifetime value |

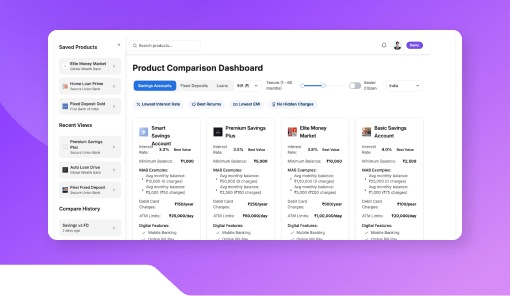

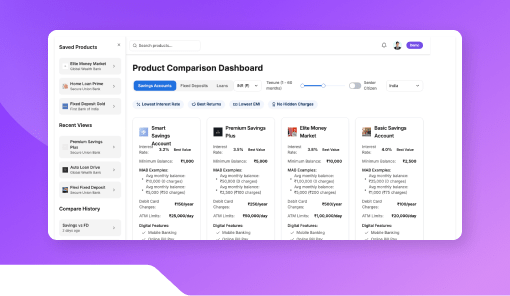

Key Features

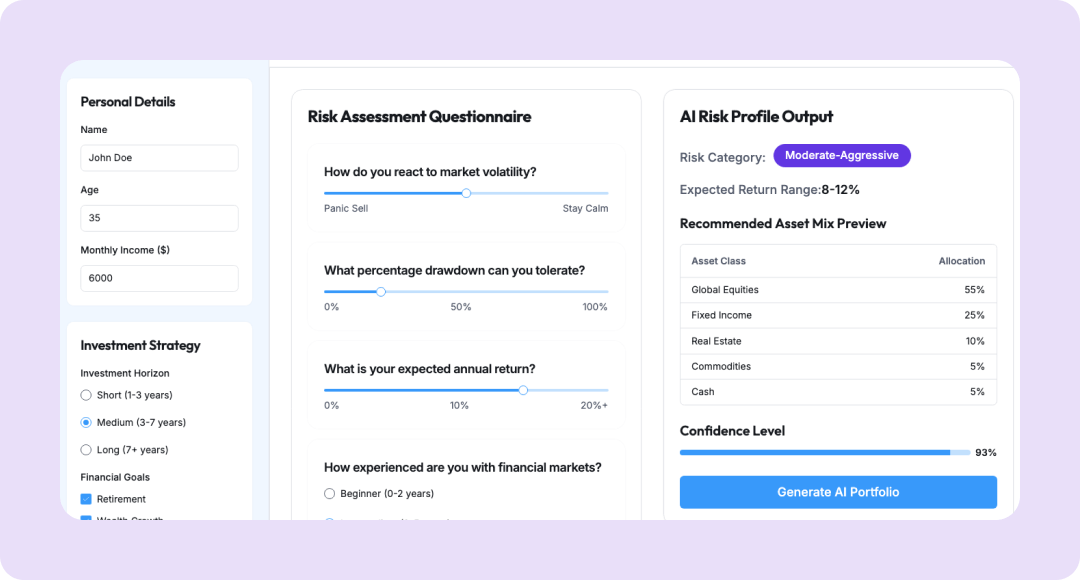

- Risk Profiling Engine: Assesses risk tolerance based on questionnaire or transaction data.

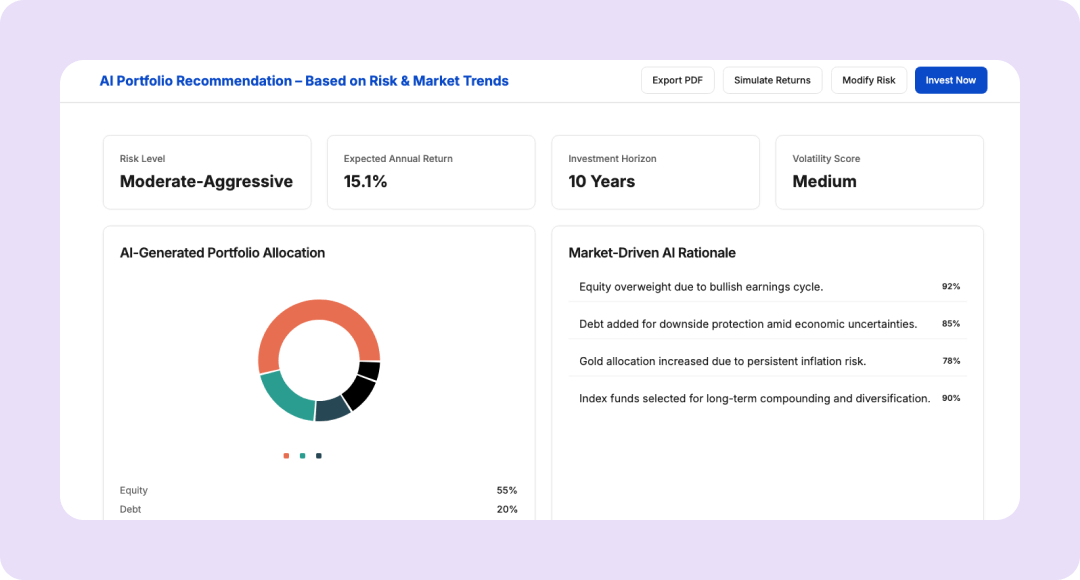

- Portfolio Recommender: Suggests ideal asset mix (equity, debt, gold, etc.) based on profile.

- Market Data Integration: Fetches real-time fund or stock performance.

- Chatbot Interface: Conversational interaction for ease of use.

- Compliance Layer: Ensures SEBI/RBI suitability requirements.

Benefits

- Personalize investment journeys for every user

- Improve customer engagement and platform retention

- Enhance compliance through transparent recommendations

- Enable scalable, self-serve advisory experiences

- Integrate AI-driven insights into existing wealth platforms

How It Works

- Connect Kriatix AI to your user database or CRM.

- Configure the risk questionnaire and mapping logic.

- Integrate with mutual fund or market data APIs.

- Deploy the chatbot or dashboard interface for users.

Add-ons & Integrations

- Wealth APIs: BSE Star MF, NSE, Morningstar, Zerodha Kite Connect

- CRM Systems: Salesforce, Zoho CRM, WealthEngine

- Analytics Tools: Power BI, Tableau, FinBox APIs

Deployment & Access

- Cloud-based with secure role access

- Embedded widget or white-label option

- Configurable compliance and advisory rules

What Our Partners Are Saying

Frequently Asked Questions

Does it replace financial advisors?

No. It enhances advisor productivity by automating research and initial recommendations.

Can it be customized for risk profiles?

Yes. You can define your own scoring and product mapping logic.

Does it work with mutual funds and stocks?

Yes. It supports multiple asset classes and APIs.

How compliant is it with SEBI norms?

Fully compliant; it supports investor disclosure, consent, and audit logs

Can it send alerts when rebalancing is needed?

Yes. Users receive notifications when portfolios need adjustment.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started