Customer Onboarding & KYC Automation

Simplify Customer Verification and Account Opening

Automate end-to-end KYC, identity verification, and onboarding with Kriatix’s AI-based KYC Automation Workflow.

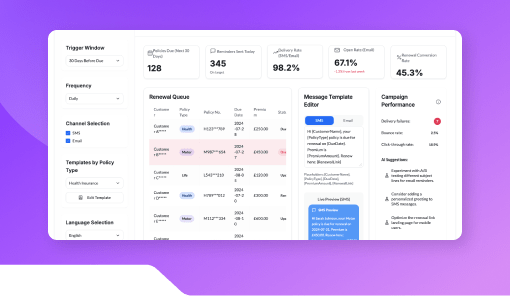

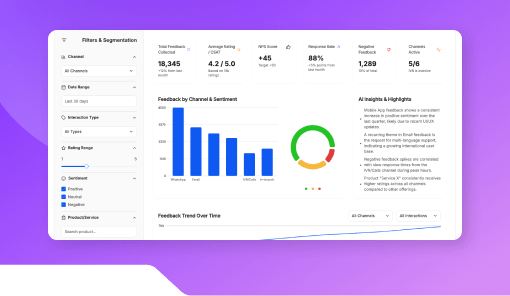

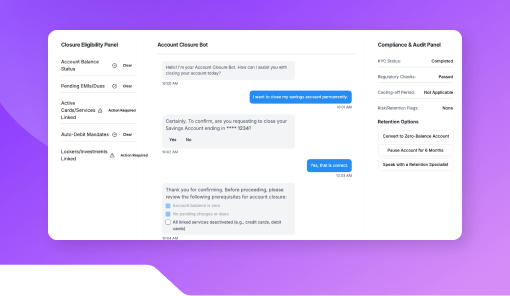

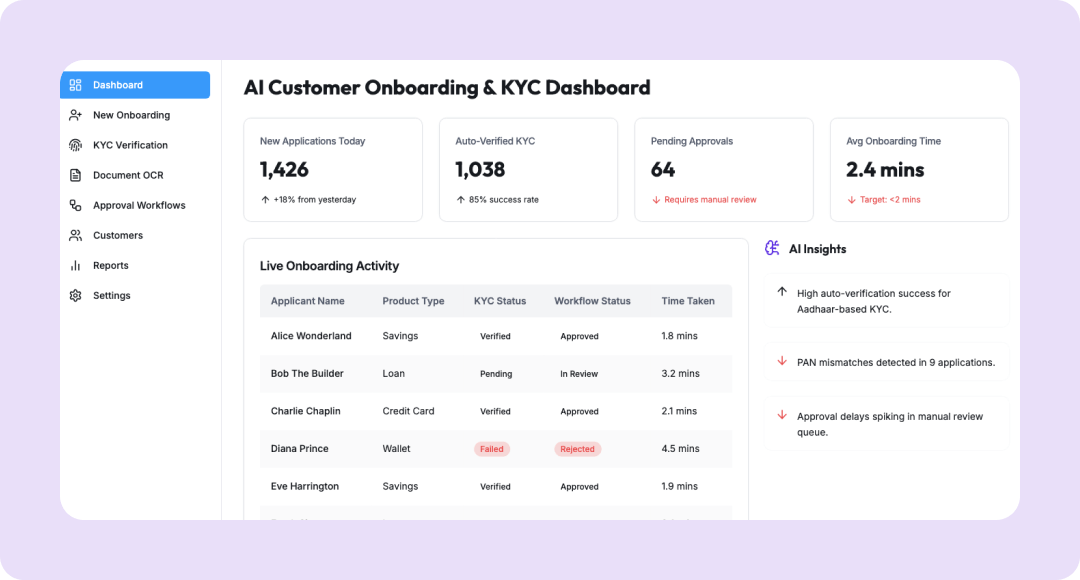

See Customer Onboarding & KYC Automation In Action

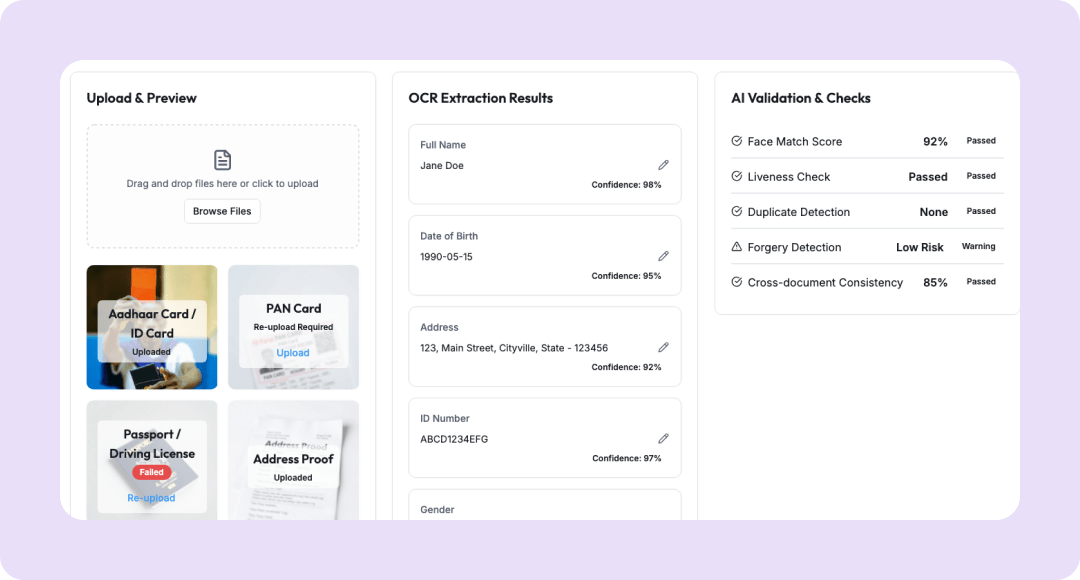

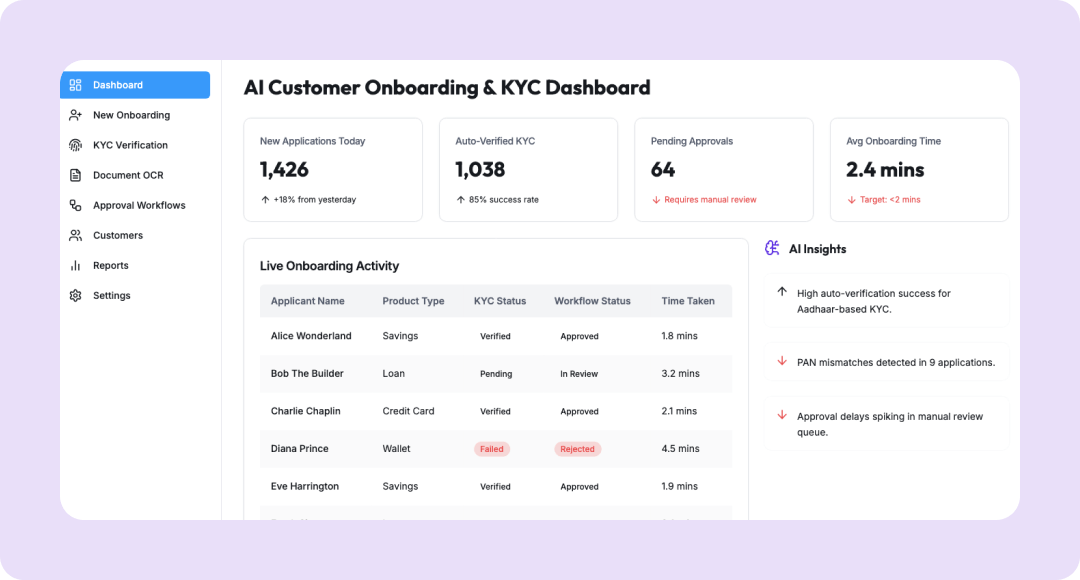

The Customer Onboarding & KYC Automation Workflow accelerates customer acquisition by digitizing identity verification, form filling, and approval routing. It uses OCR to extract data from KYC documents, AI to validate details, and workflow triggers to approve or reject applications automatically. This eliminates manual errors, ensures compliance, and improves customer experience.

🔹 AI-based identity verification and document matching

🔹 OCR-powered data extraction from KYC documents

🔹 Automated approval routing and notifications

What Is the Customer Onboarding & KYC Automation Workflow?

This workflow replaces manual KYC with an intelligent, automated verification process. It reads IDs (PAN, Aadhaar, passport, etc.), matches them against databases, and validates photo or signature authenticity. It then triggers an automated onboarding flow with audit-ready records.

Who Is It For?

| Role | How They Benefit |

|---|---|

| FinTech & Banking Teams | Speed up customer acquisition and reduce drop-offs |

| Compliance Officers | Ensure adherence to KYC and AML norms |

| Operations Teams | Eliminate manual document handling |

| Developers | Embed eKYC APIs into onboarding workflows |

| CX Managers | Deliver a smooth and fast onboarding journey |

Key Features

- OCR Extraction Engine: Reads and parses PAN, Aadhaar, and other IDs.

- Face Match & Verification: Confirms live photo vs ID photo match.

- AML & Sanction Screening: Cross-checks with regulatory watchlists.

- Workflow Approval Builder: Triggers onboarding or escalation automatically.

Benefits

- Reduce KYC verification time by 90%

- Maintain regulatory compliance effortlessly

- Improve customer satisfaction with instant onboarding

- Eliminate paperwork and manual review errors

- Scale KYC processing without additional staff

How It Works

- Connect APIs for ID verification and AML databases.

- Configure data extraction and matching templates.

- Deploy workflow on onboarding portals or mobile apps.

- Track onboarding status via a centralized dashboard.

Add-ons & Integrations

- Verification APIs: Digilocker, UIDAI, NSDL, Karza

- Core Systems: CRM, LMS, or FinTech app backend

- Storage: AWS S3, Azure Blob, or internal database

Deployment & Access

- SaaS, on-premise, or hybrid deployment

- Admin dashboard for compliance monitoring

- End-to-end data encryption and audit logging

What Our Partners Are Saying

Frequently Asked Questions

Does it support video KYC?

Yes. Video-based verification can be enabled with face match checks.

Is it RBI and SEBI compliant?

Yes. It adheres to current KYC and AML guidelines.

Can it integrate with multiple KYC providers?

Yes. Multiple API sources can be configured for redundancy.

How secure is user data?

Fully encrypted and stored following ISO 27001 standards.

Does it work for both individual and corporate KYC?

Yes. It supports both personal and business account verification.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started