Credit Report Reader

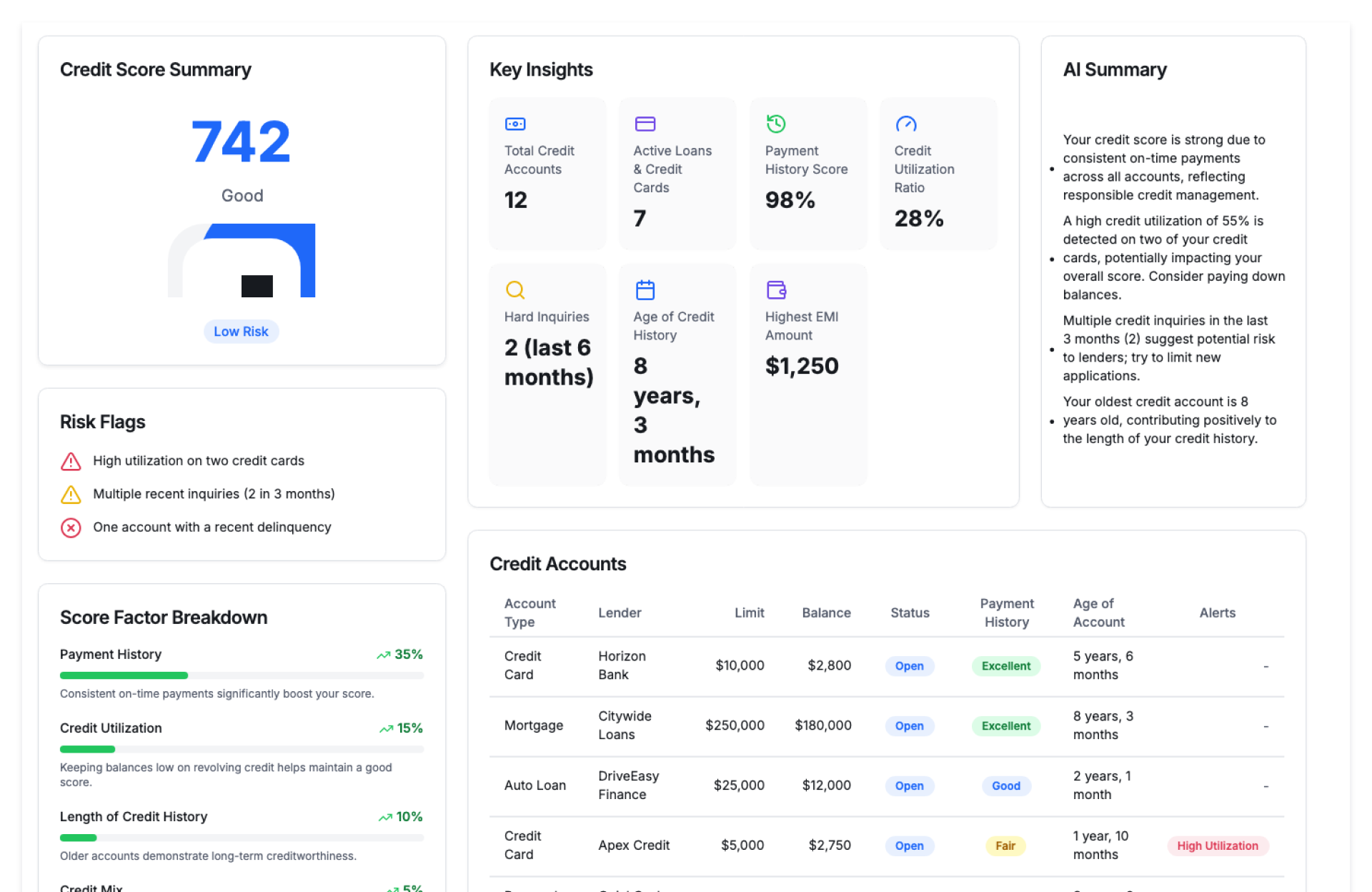

Turn Credit Reports Into Clear, Actionable Insights

Summarize uploaded credit reports.

See Credit Report Reader In Action

The Credit Report Reader by Kriatix automatically reads, interprets, and structures credit reports into easy-to-understand insights. It helps lending, risk, and finance teams quickly assess creditworthiness without manually reviewing lengthy reports.

Built for accuracy and speed, this tool brings clarity to complex credit data.

🔹 Start Free Trial

🔹 Book a Demo

🔹 Request Pricing

What Is the Credit Report Reader?

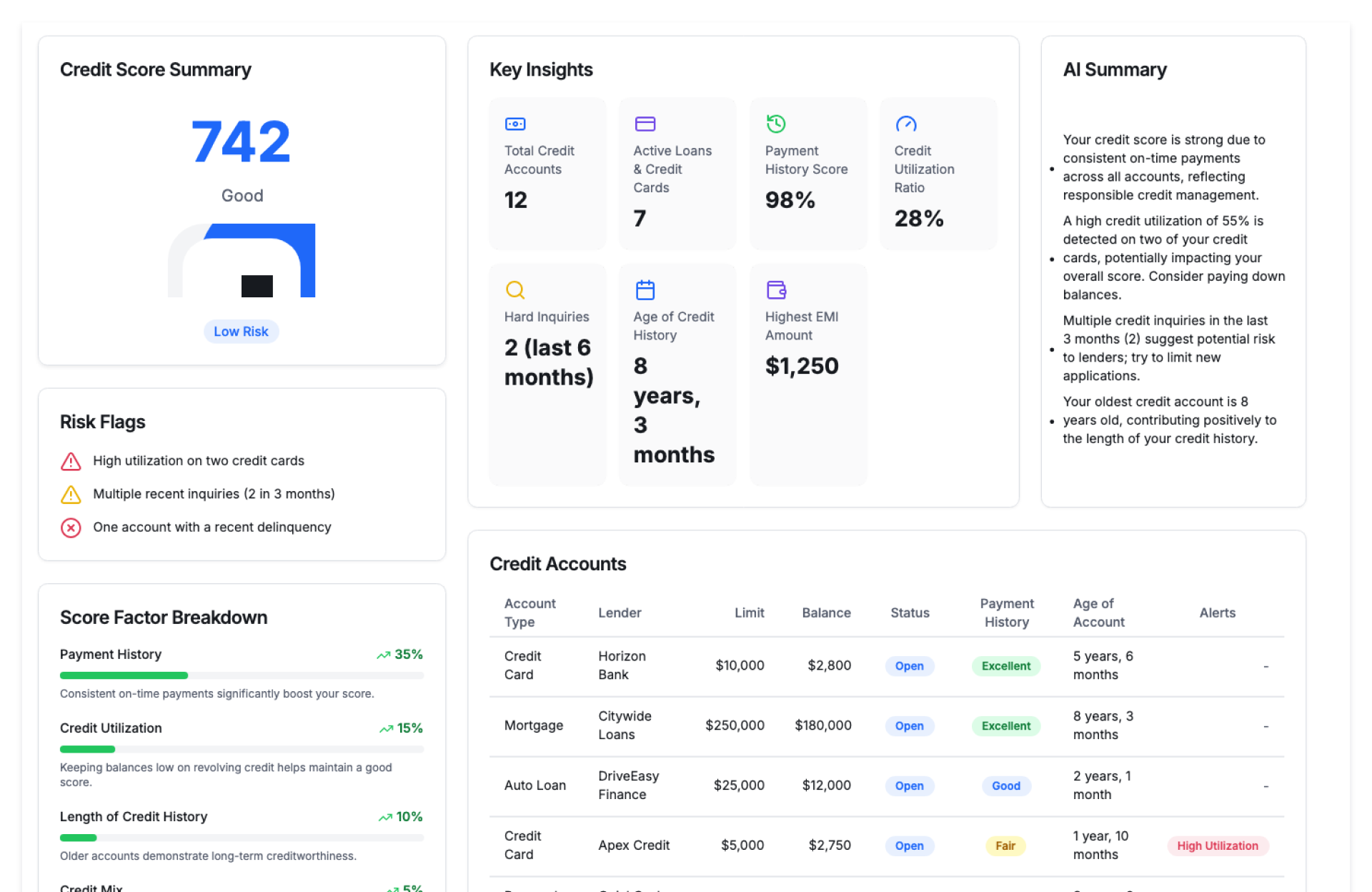

The Credit Report Reader is an intelligent solution that extracts key information from credit bureau reports and presents it in a structured, decision-ready format. It highlights scores, repayment behavior, liabilities, and risk indicators so teams can evaluate profiles faster and more consistently.

The reader adapts to different report formats while maintaining reliable interpretation.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Credit & Risk Teams | Assess credit profiles quickly |

| Lending Teams | Speed up loan evaluations |

| Finance Teams | Understand liabilities and repayment history |

| Compliance Teams | Validate credit data efficiently |

| Founders & CXOs | Gain clarity into portfolio risk |

Key Features

- Automated credit report parsing

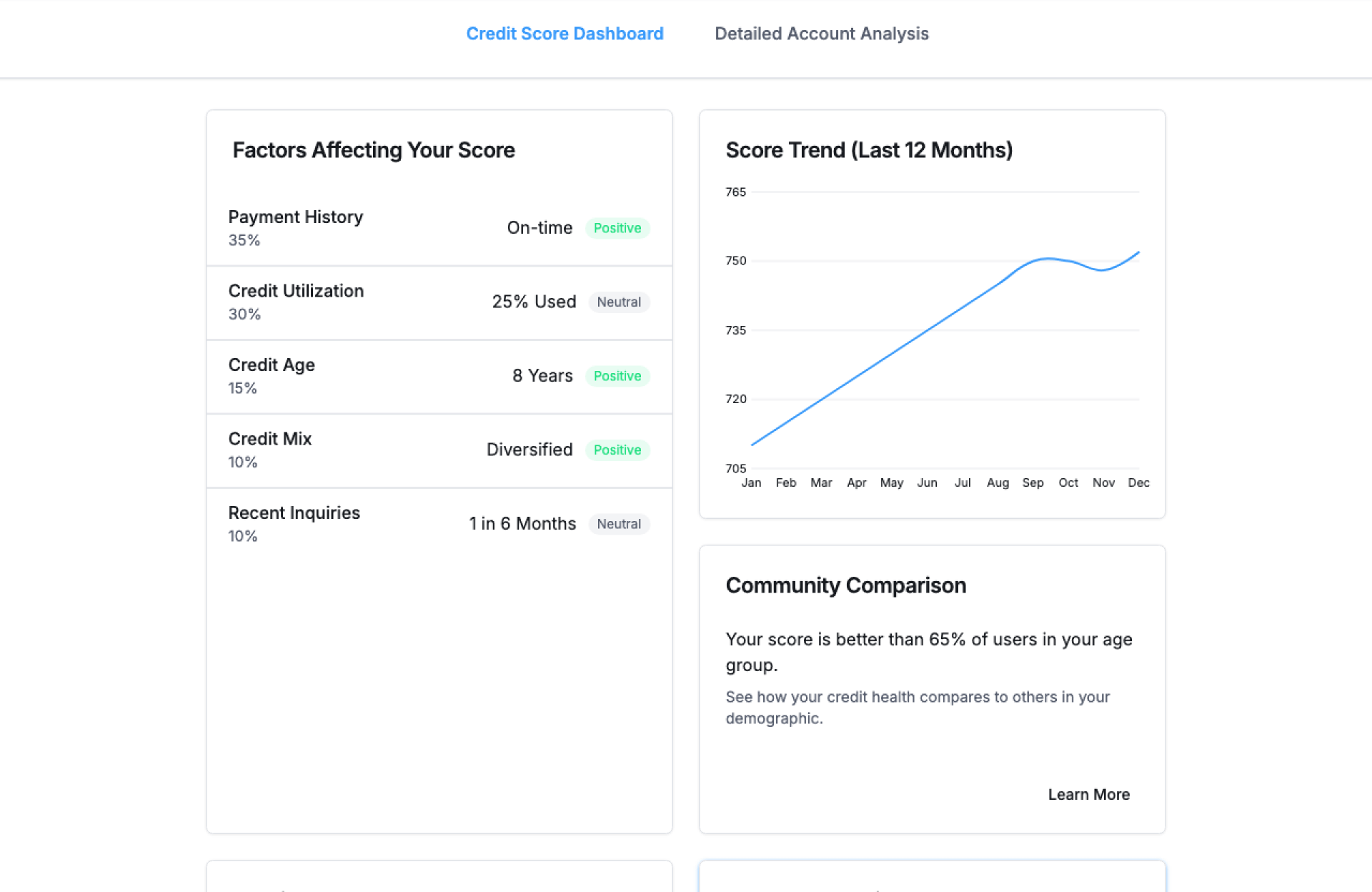

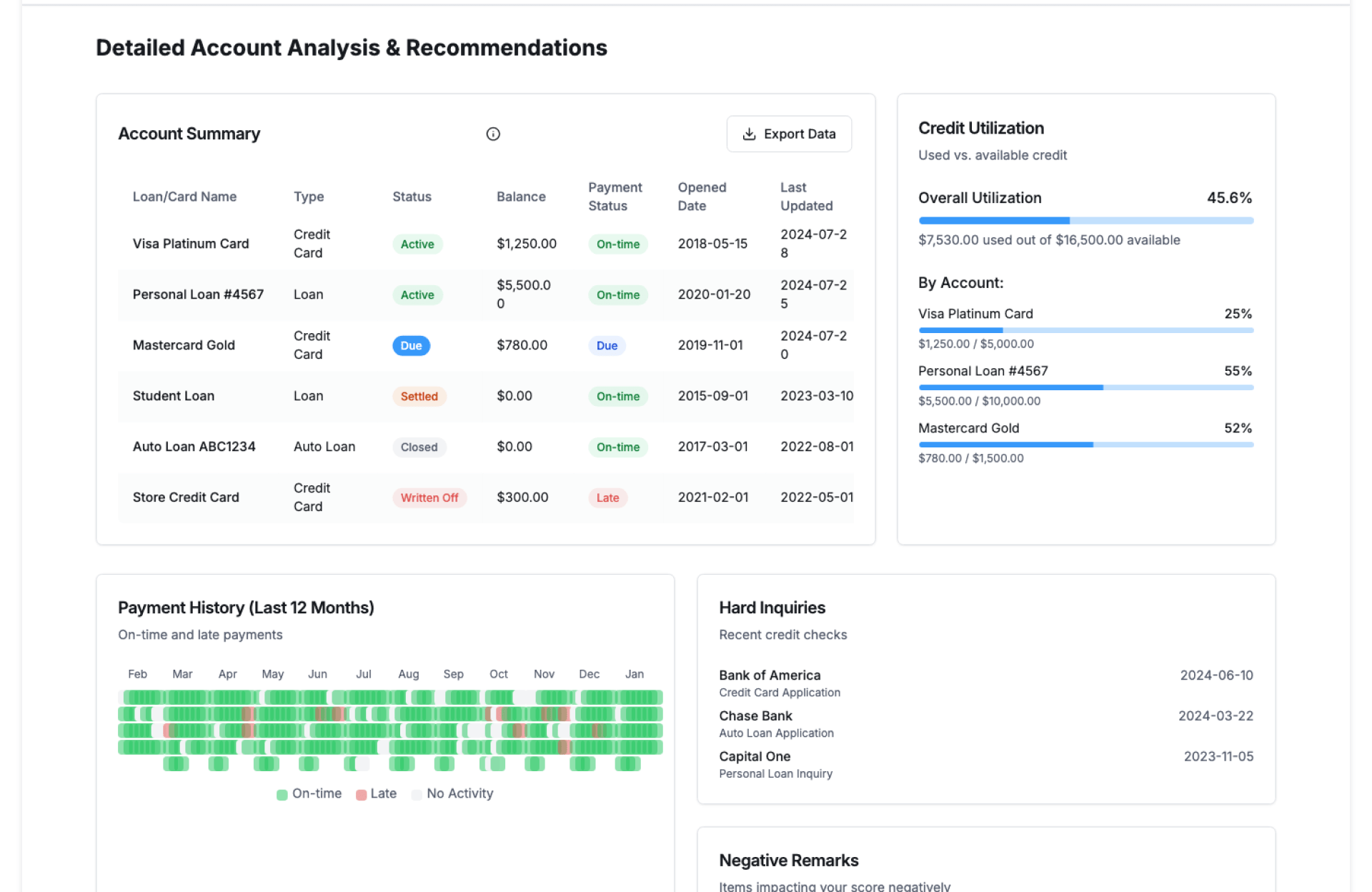

- Credit score and history extraction

- Identification of active loans and liabilities

- Repayment behavior and delinquency insights

- Standardized credit summaries

- Support for multiple credit report formats

- Export-ready structured outputs

Benefits

- Reduce manual credit report review time

- Improve consistency in credit assessment

- Speed up lending and approval decisions

- Minimize oversight of critical risk signals

- Handle higher application volumes with ease

- Enable faster, data-backed decisions

How It Works

- Upload Credit Reports – Add bureau reports in supported formats

- Extract Key Data – Read scores, accounts, and repayment details

- Structure Insights – Organize data into clear summaries

- Review Risk Indicators – Highlight delinquencies and exposures

- Export or Integrate – Use insights for lending or analysis

Add-ons & Integrations

- Loan Application Tracker

- Credit Risk Scoring Module

- Document Verification Tools

- Finance Analytics Dashboard

- API access for lending systems

Deployment & Access

- Web-based interface

- Cloud or on-premise deployment

- Secure data handling and audit logs

- Role-based access and controls

What Our Partners Are Saying

Frequently Asked Questions

Which credit reports are supported?

The reader supports major credit bureau report formats.

Can it highlight risk indicators automatically?

Yes. Delinquencies, overdue accounts, and liabilities are flagged.

Is manual review still possible?

Yes. Teams can review extracted data alongside original reports.

Can results be exported?

Yes. Structured summaries can be exported for analysis or records.

Is credit data handled securely?

Yes. Enterprise-grade security and access controls are applied.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started