Loan Eligibility Calculator

Instantly Check Loan Eligibility With Clear Criteria

Quick estimate based on user input.

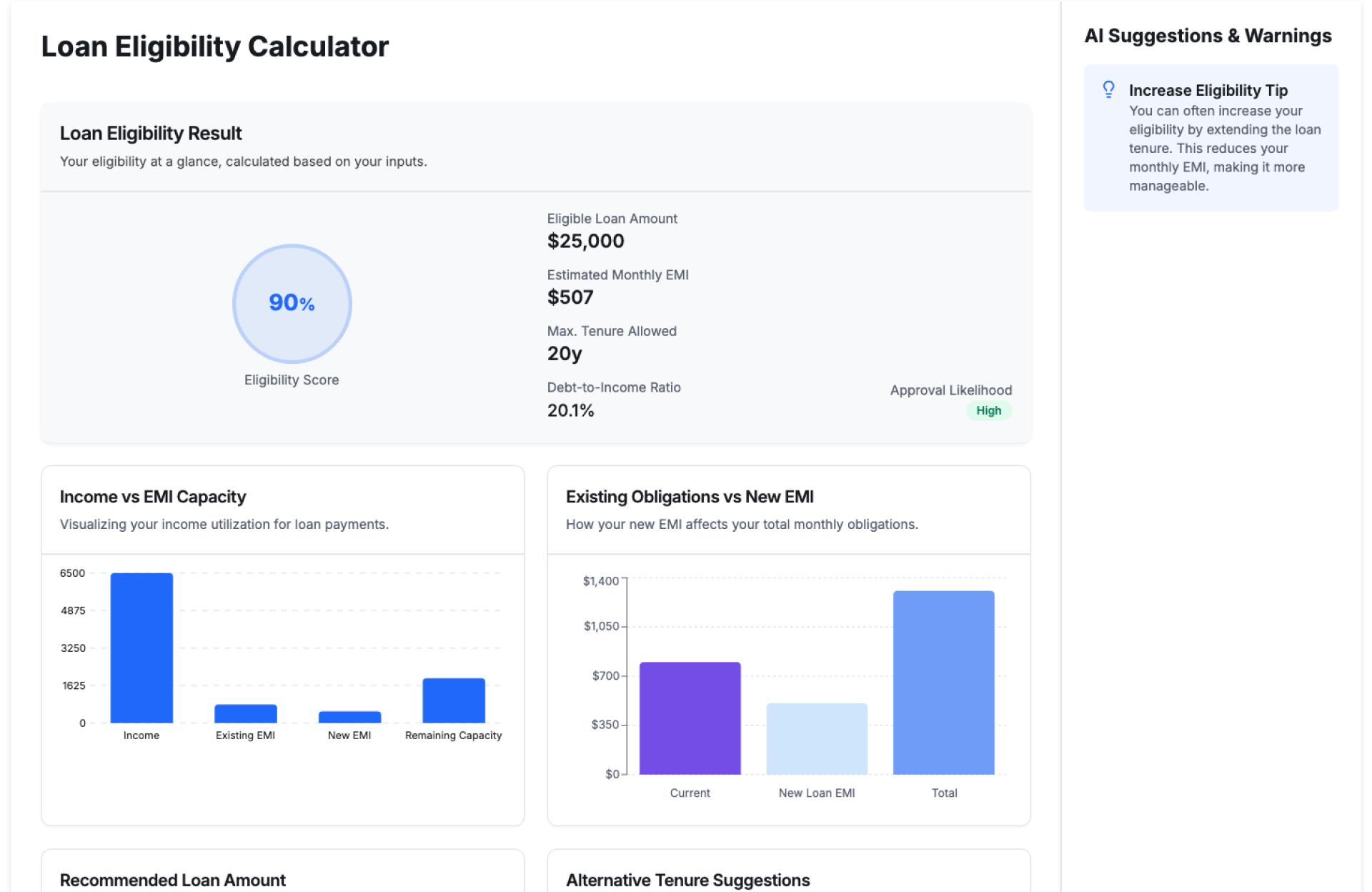

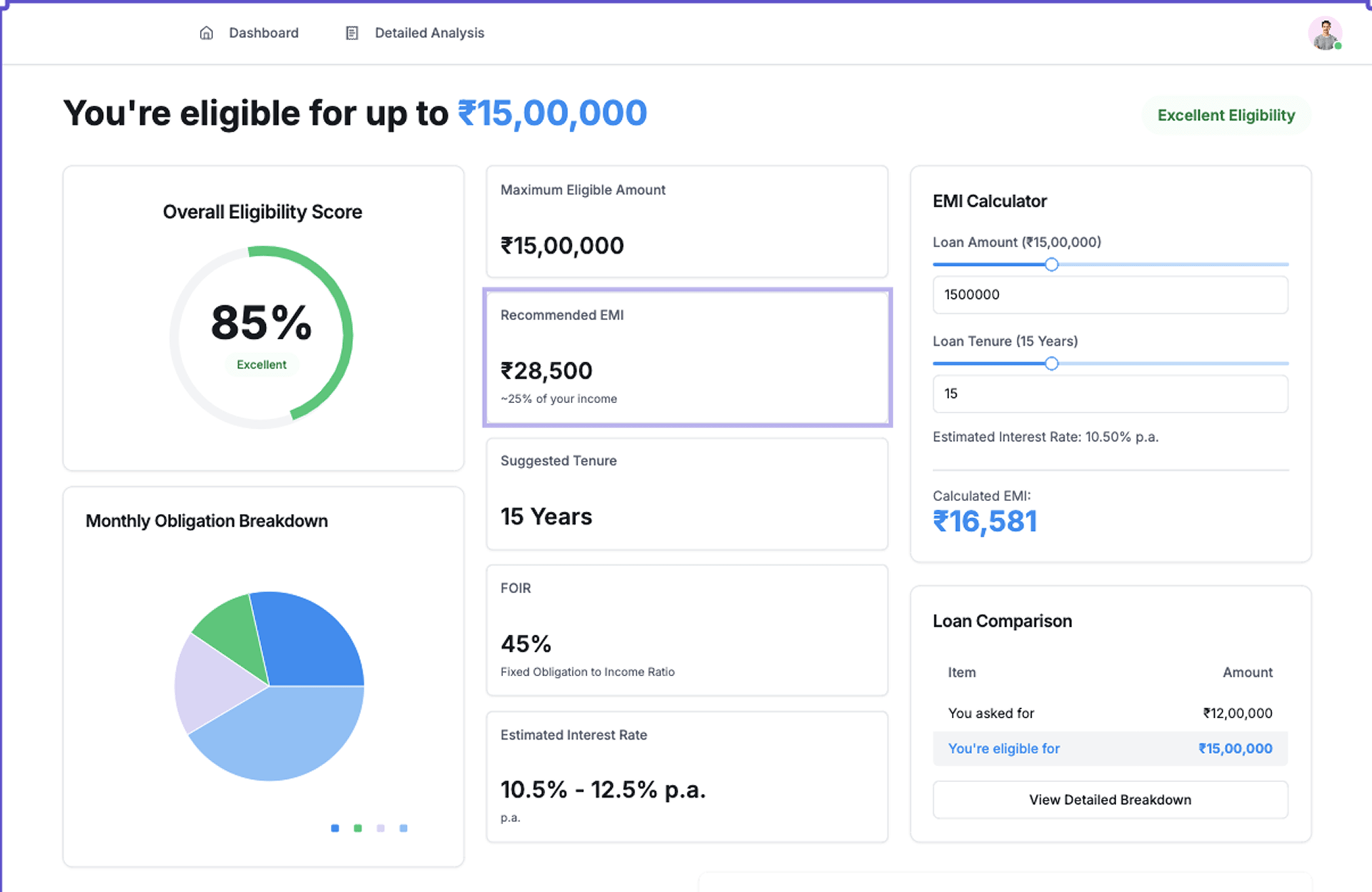

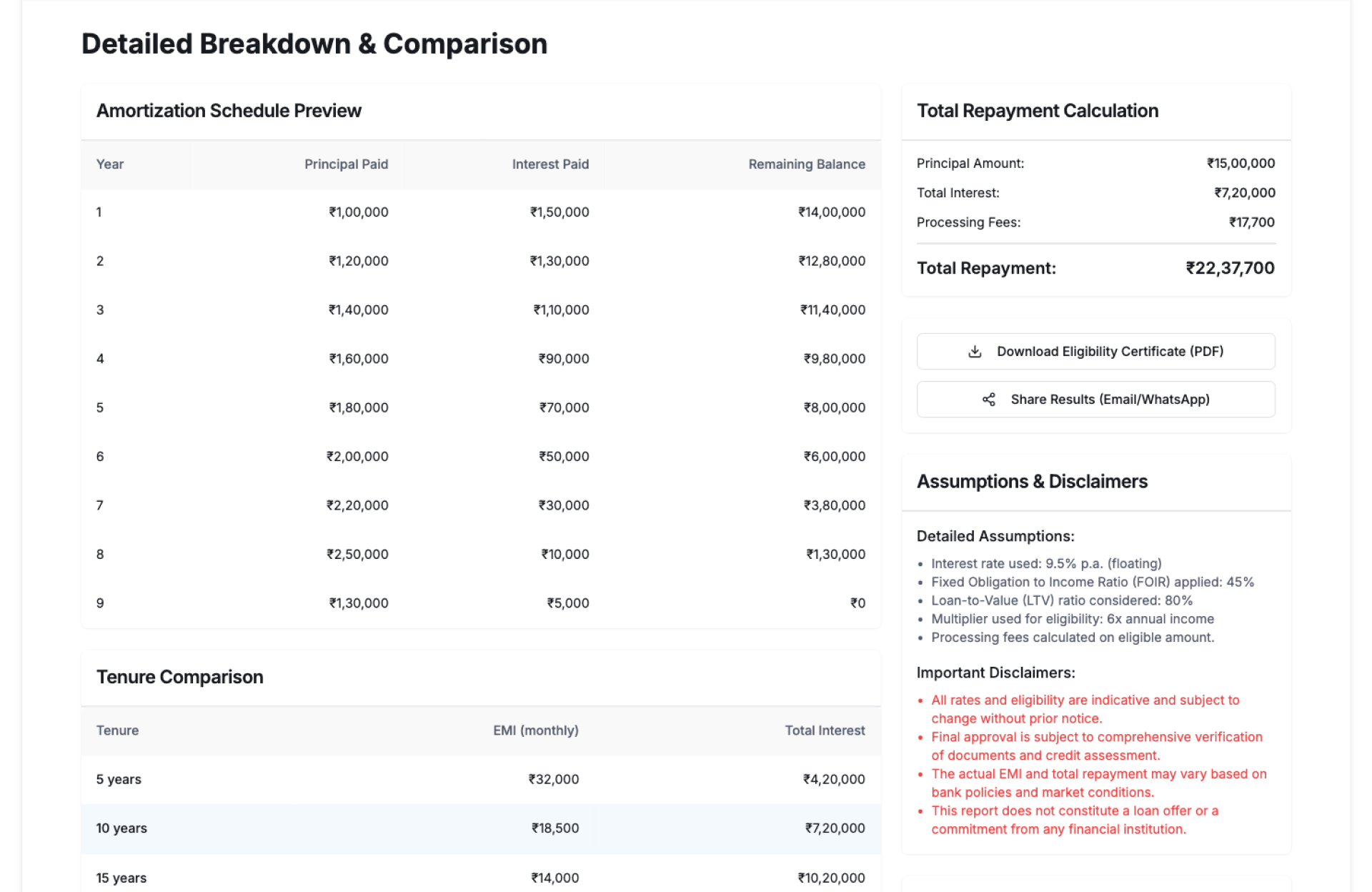

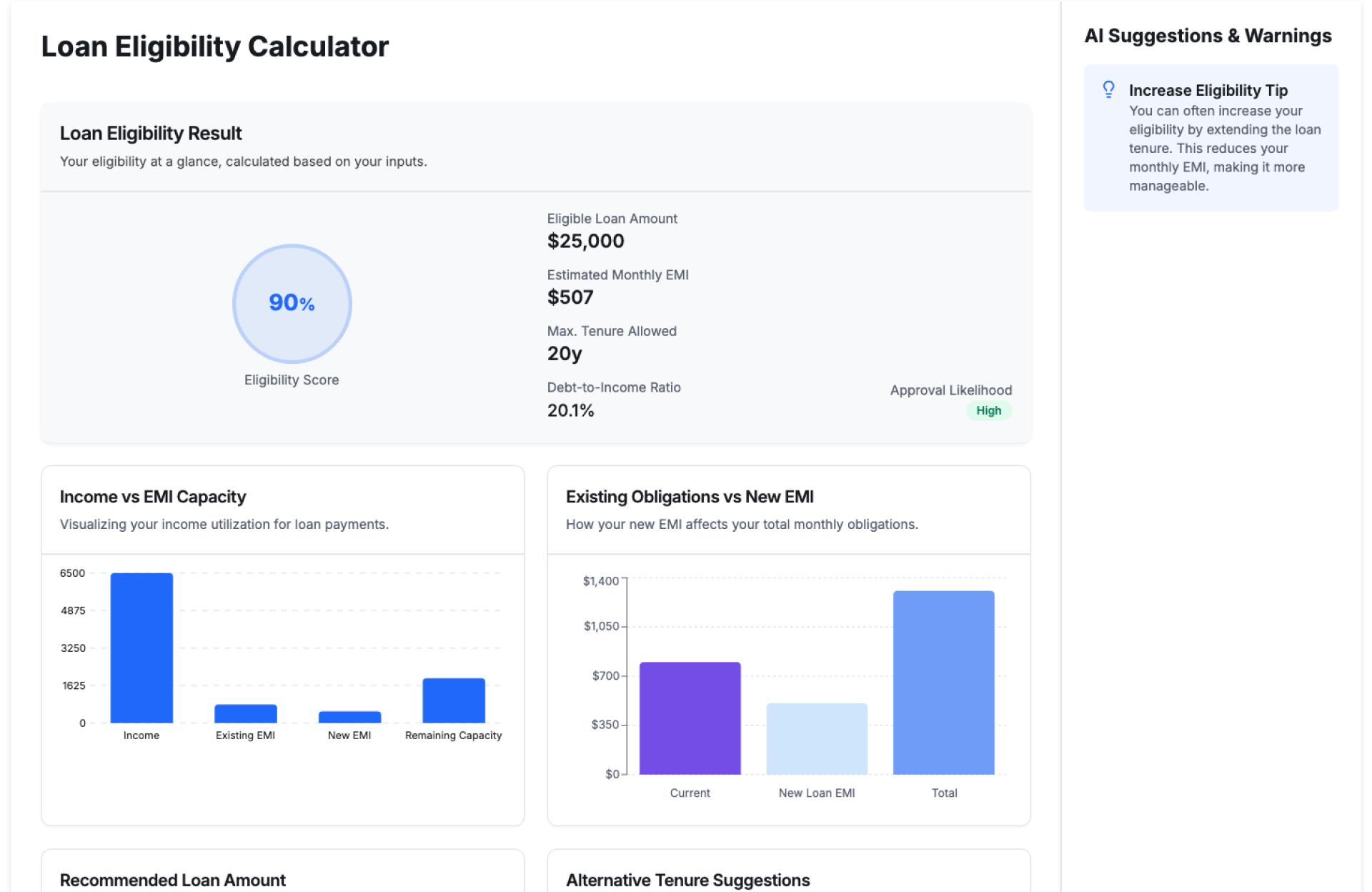

See Loan Eligibility Calculator In Action

The Loan Eligibility Calculator by Kriatix helps lenders and financial teams quickly assess whether an applicant qualifies for a loan. By analyzing income, liabilities, credit indicators, and predefined rules, it delivers instant eligibility outcomes without manual calculations.

Built to support faster decisions, this tool improves turnaround time while keeping evaluations consistent and transparent.

🔹 Start Free Trial

🔹 Book a Demo

🔹 Request Pricing

What Is the Loan Eligibility Calculator?

The Loan Eligibility Calculator is a configurable assessment tool that evaluates applicant data against eligibility parameters such as income thresholds, obligations, credit indicators, and policy rules. It produces a clear eligibility result along with supporting metrics to help teams move applications forward confidently.

It adapts easily to different loan products and eligibility frameworks.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Lending Teams | Quickly determine applicant eligibility |

| Credit Teams | Apply consistent eligibility criteria |

| Operations Teams | Reduce manual eligibility checks |

| Customer Support Teams | Answer eligibility-related questions faster |

| Founders & CXOs | Improve approval efficiency and predictability |

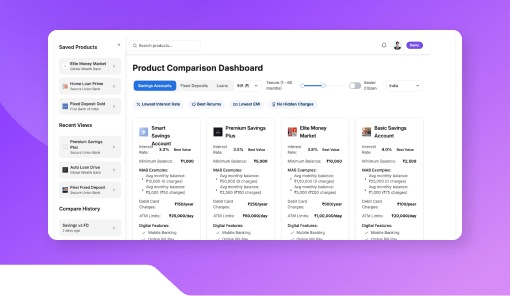

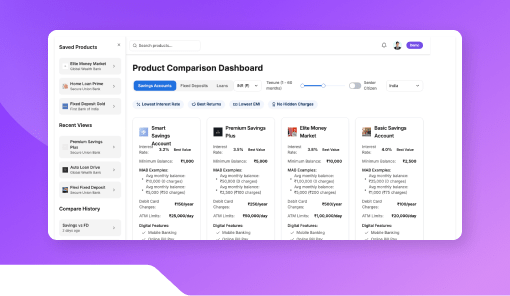

Key Features

- Instant loan eligibility assessment

- Configurable eligibility rules and thresholds

- Income and obligation analysis

- Credit indicator evaluation

- Clear pass, fail, or review outcomes

- Applicant-level eligibility summaries

- Export-ready assessment reports

Benefits

- Speed up loan screening and approvals

- Eliminate manual eligibility calculations

- Ensure consistent decision-making

- Reduce back-and-forth with applicants

- Adapt criteria to changing policies

- Improve overall lending efficiency

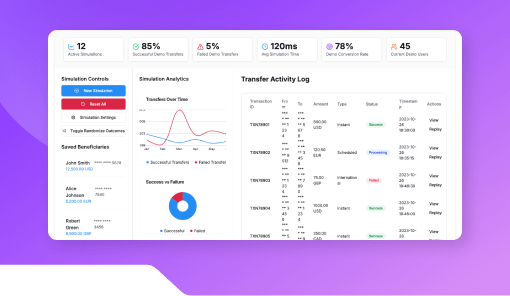

How It Works

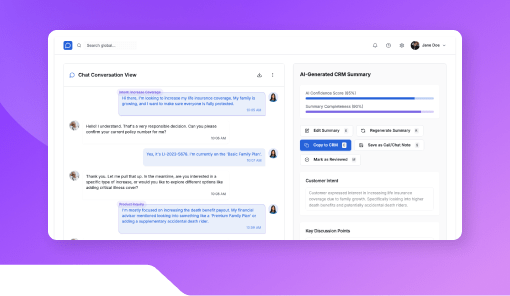

- Capture Applicant Data – Ingest income, obligations, and profile details

- Apply Eligibility Rules – Evaluate against predefined criteria

- Calculate Eligibility – Generate instant qualification results

- Review Outcomes – Identify approved, rejected, or review cases

- Proceed With Next Steps – Move eligible applications forward

Add-ons & Integrations

- Credit Report Reader

- Loan Application Tracker

- Risk Scoring Module

- KYC Document Validator

- API access for lending platforms

Deployment & Access

- Web-based interface

- Cloud or on-premise deployment

- Secure data handling and controls

- Role-based access and permissions

What Our Partners Are Saying

Frequently Asked Questions

Can eligibility rules be customized?

Yes. Eligibility criteria can be configured for different loan products.

Does it use credit-related indicators?

Yes. Credit indicators can be included as part of eligibility checks.

Can borderline cases be flagged for review?

Yes. Applications can be marked for manual review when needed.

Is historical eligibility data available?

Yes. Past assessments can be reviewed for analysis and audits.

Can this integrate with loan workflows?

Yes. It integrates with loan processing and decision systems.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started