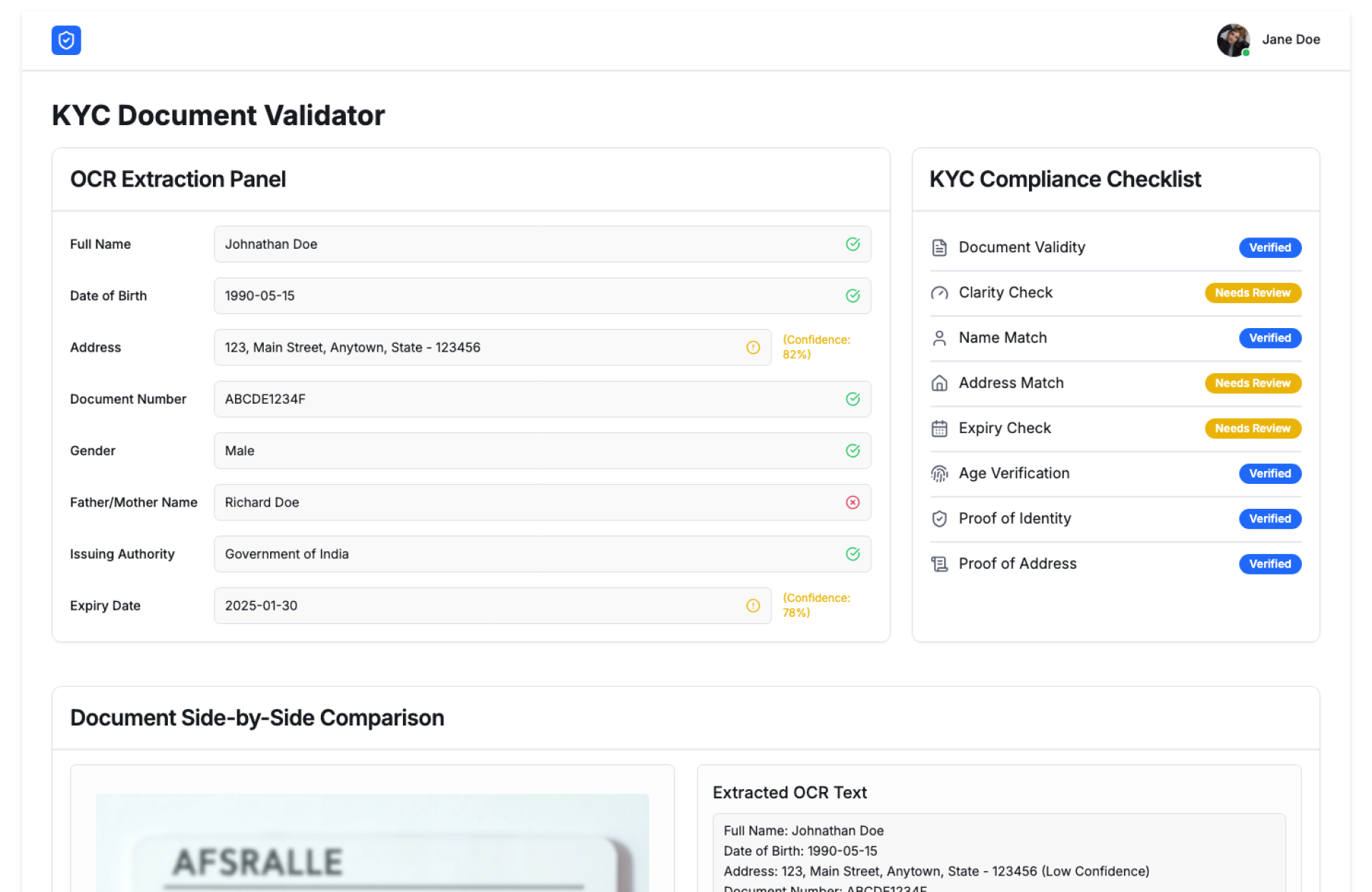

KYC Document Validator

Verify Identity Documents Faster and With Confidence

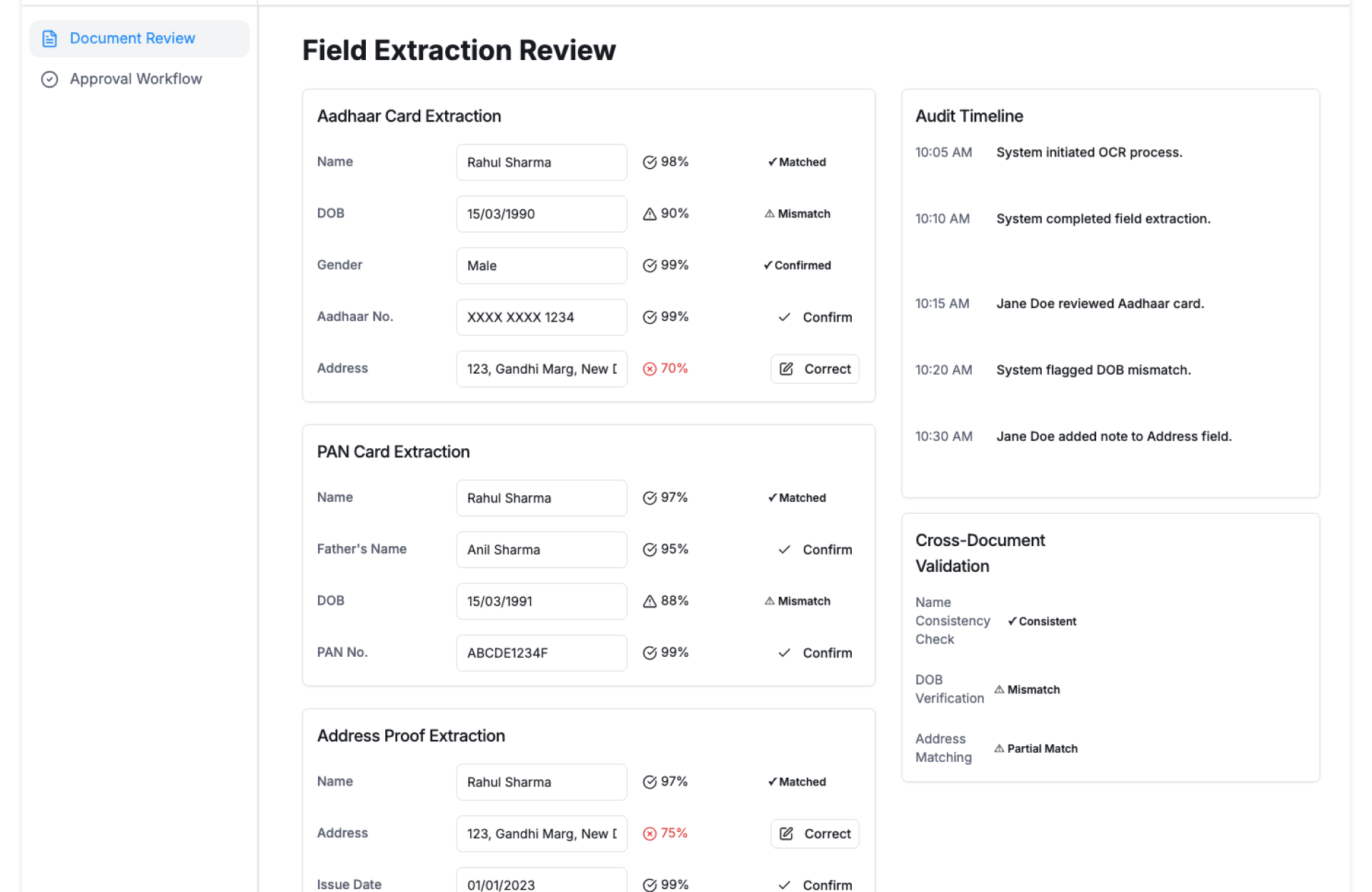

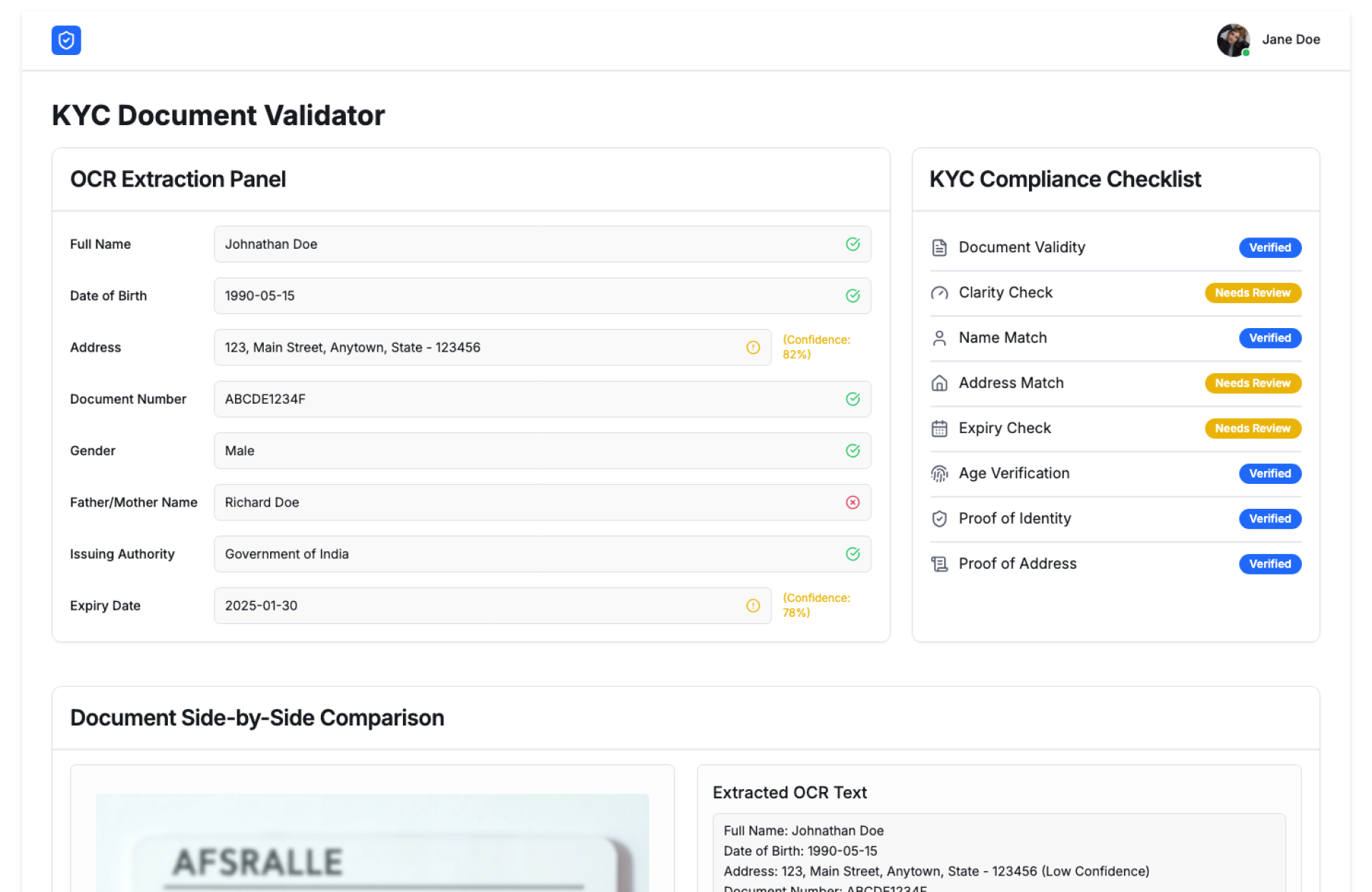

OCR-based field extraction and checklist.

See KYC Document Validator In Action

The KYC Document Validator by Kriatix helps businesses validate identity and compliance documents quickly, accurately, and at scale. It automates document checks, reduces manual review effort, and ensures KYC processes stay consistent and audit-ready.

Built for regulated environments, this tool streamlines onboarding without compromising security or compliance.

🔹 Start Free Trial

🔹 Book a Demo

🔹 Request Pricing

What Is the KYC Document Validator?

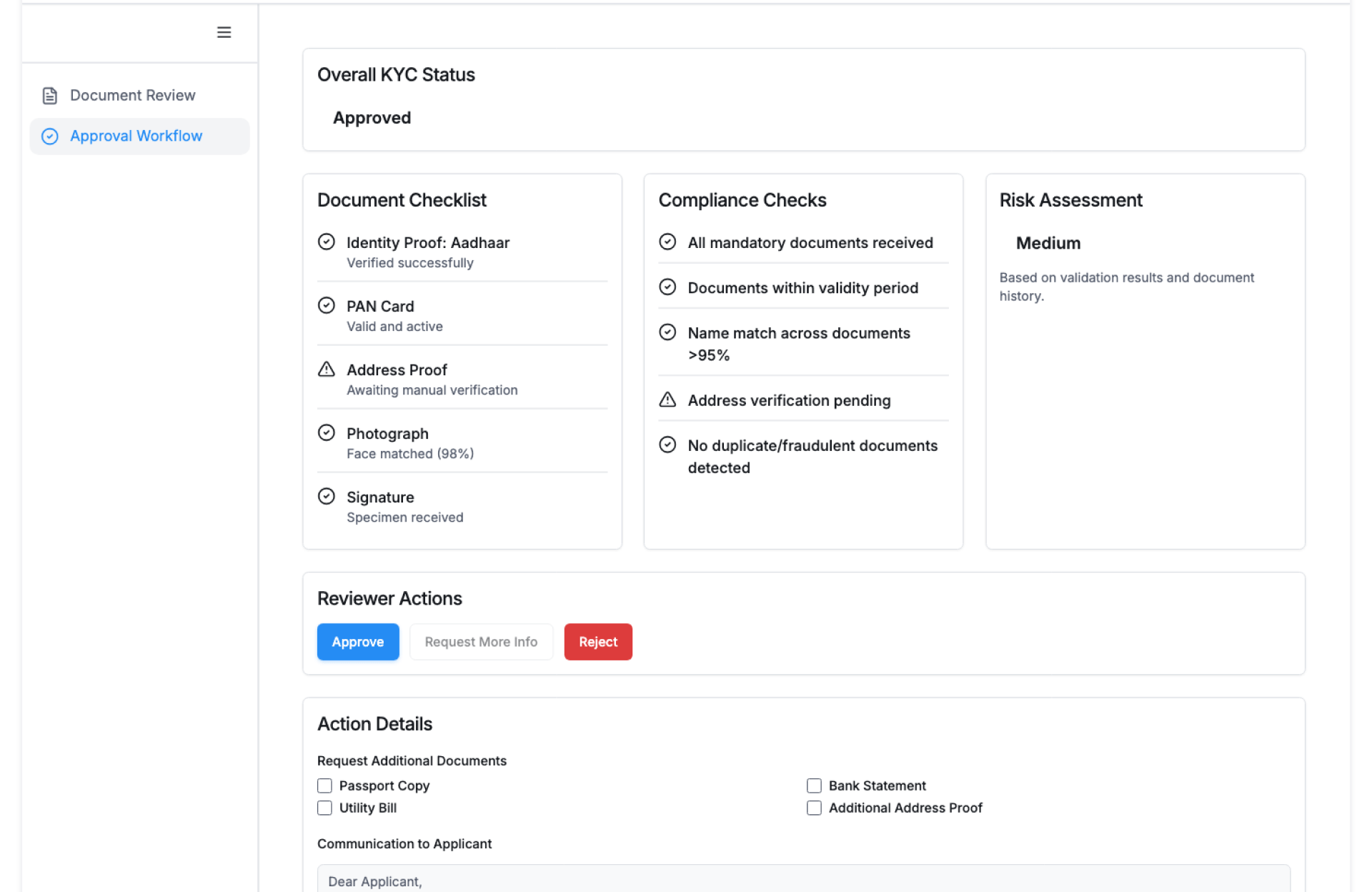

The KYC Document Validator is an automated solution that verifies identity documents such as ID proofs, address proofs, and supporting KYC records. It checks document completeness, authenticity indicators, and data consistency to help teams approve customers faster and with greater confidence.

It supports varied document formats while maintaining standardized validation outcomes.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Compliance Teams | Ensure accurate and consistent KYC checks |

| Risk & Fraud Teams | Detect invalid or suspicious documents |

| Operations Teams | Reduce manual document verification effort |

| Lending & Banking Teams | Speed up customer onboarding |

| Founders & CXOs | Maintain compliance visibility and control |

Key Features

- Automated validation of KYC documents

- Identity and address proof verification

- Data consistency and completeness checks

- Document status and validation flags

- Support for multiple document formats

- Exception handling for manual review

- Audit-ready validation logs

Benefits

- Accelerate KYC and onboarding timelines

- Reduce human errors in document checks

- Improve compliance consistency

- Scale verification without adding headcount

- Strengthen fraud prevention processes

- Maintain clear audit trails

How It Works

- Upload Documents – Submit KYC documents digitally

- Run Validation Checks – Verify identity and data fields

- Flag Exceptions – Identify missing or inconsistent details

- Review & Approve – Resolve exceptions when required

- Store Validation Logs – Maintain audit-ready records

Add-ons & Integrations

- Credit Report Reader

- Loan Application Tracker

- Fraud & Risk Detection Module

- Customer Onboarding Systems

- API access for enterprise platforms

Deployment & Access

- Web-based interface

- Cloud or on-premise deployment

- Secure document handling and storage

- Role-based access and permissions

What Our Partners Are Saying

Frequently Asked Questions

Which documents can be validated?

The validator supports common identity and address proof documents used in KYC processes.

Can exceptions be reviewed manually?

Yes. Documents flagged during validation can be reviewed and approved manually.

Does it support high-volume onboarding?

Yes. It is designed to scale for large onboarding volumes.

Are validation logs audit-ready?

Yes. All actions are logged for compliance and audits.

Is sensitive identity data secure?

Yes. Enterprise-grade security and access controls are enforced.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started