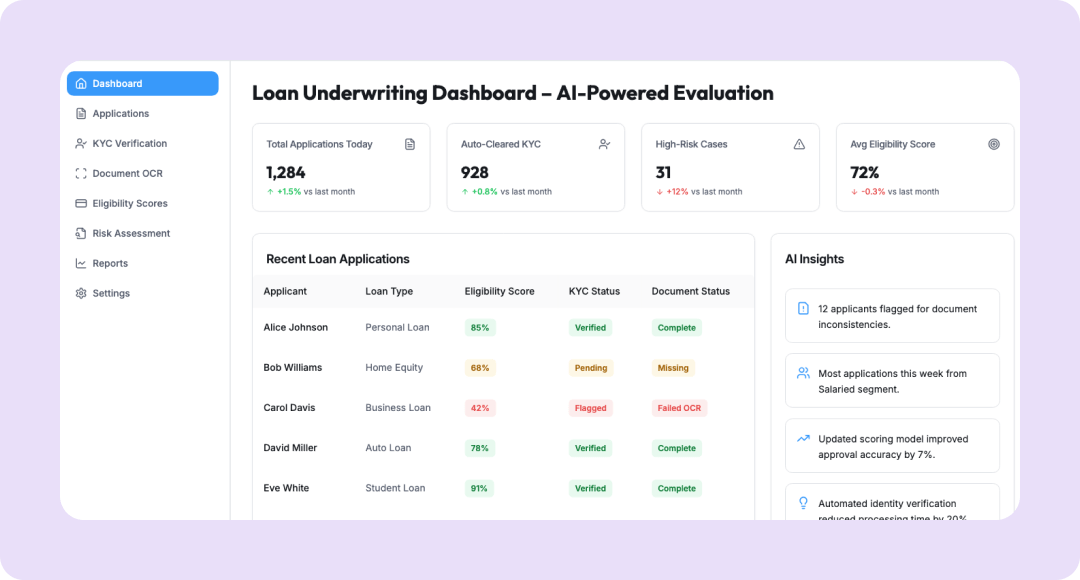

Loan Eligibility & Underwriting Assistant

Automate Loan Eligibility and Underwriting Decisions with AI

Speed up credit approvals by analyzing applicant data, documents, and risk factors using Kriatix’s AI-powered Underwriting Assistant.

See Loan Eligibility & Underwriting Assistant In Action

The Loan Eligibility & Underwriting Assistant automates the credit evaluation process by reading financial documents, analyzing applicant risk, and assigning eligibility scores. It combines OCR for document extraction, AI for scoring, and rule-based workflows for decision logic—reducing underwriting time from days to minutes. It’s built for banks, NBFCs, and lending fintech platforms seeking speed, accuracy, and compliance.

🔹 Automate document review and scoring

🔹 Evaluate risk using AI and historical data

🔹 Reduce underwriting time dramatically

What Is the Loan Eligibility & Underwriting Assistant?

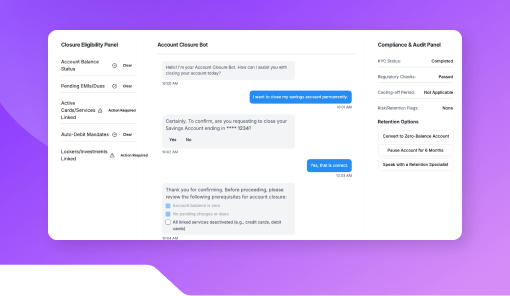

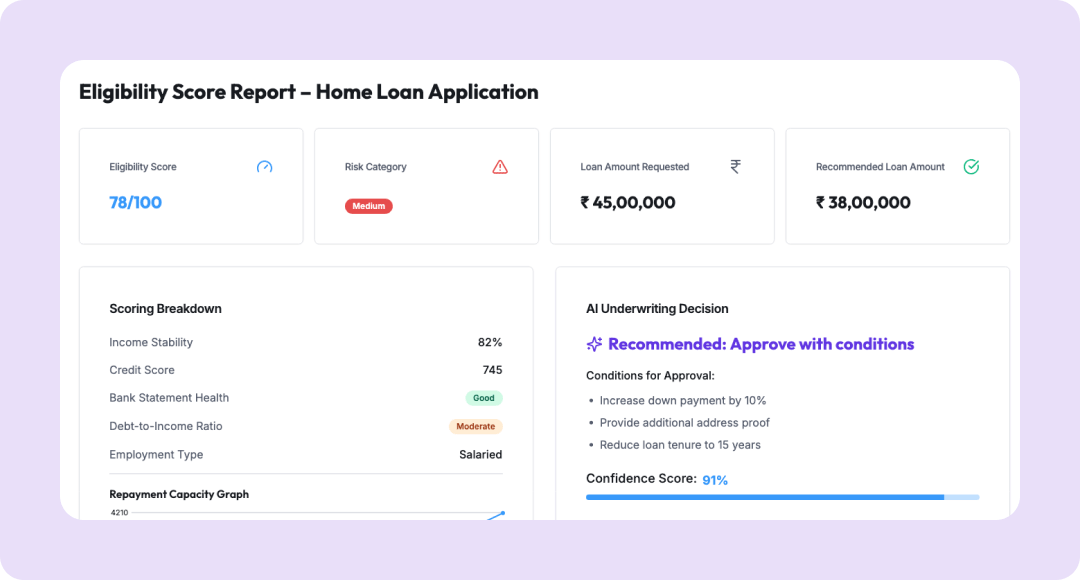

The Underwriting Assistant acts as a digital analyst that evaluates multiple data points: income proof, credit history, transaction behavior, and KYC documents.It validates uploaded data, assigns an eligibility score, and generates a recommendation (“Approve”, “Review”, or “Reject”).This workflow ensures consistent decision-making while reducing dependency on manual judgment.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Underwriters | Automate credit checks and reduce workload |

| Risk Teams | Ensure consistency and compliance in approvals |

| FinTech Platforms | Speed up loan approval journeys |

| CFOs/Credit Heads | Improve NPA forecasting and control |

| Developers/Product Teams | Embed AI decision APIs in lending flows |

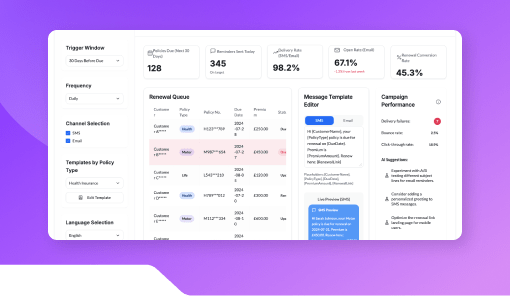

Key Features

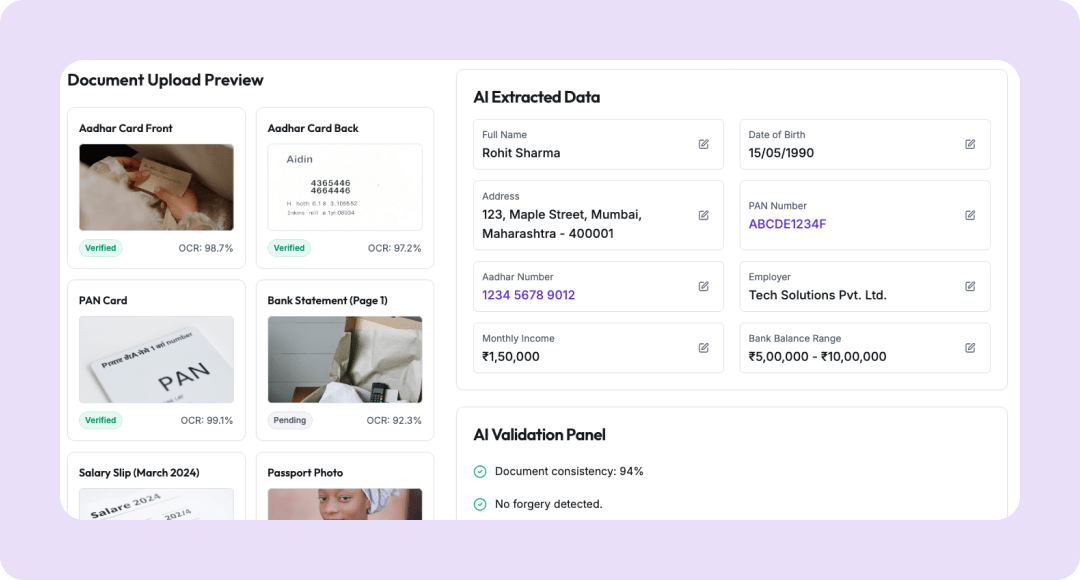

- Document Extraction Engine: Uses OCR to read pay slips, bank statements, and IDs.

- Credit Scoring AI: Calculates eligibility and assigns risk levels.

- Decision Workflow Builder: Configurable approval/rejection logic.

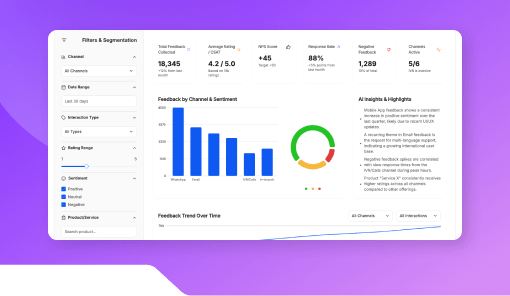

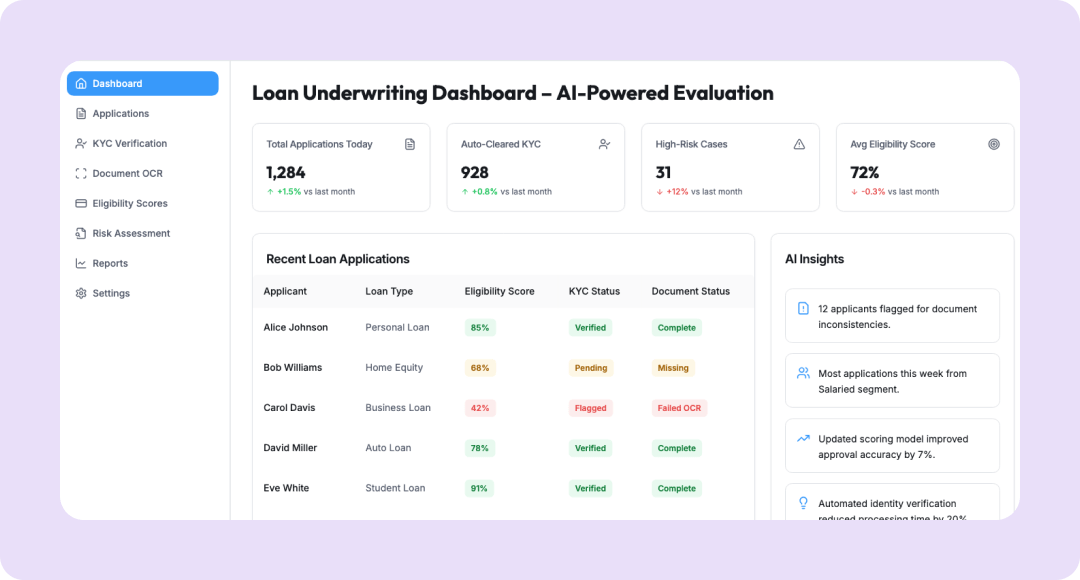

- Audit Dashboard: Stores decision history for compliance.

Benefits

- Cut underwriting turnaround time by 80%

- Improve decision accuracy with data-driven insights

- Standardize evaluation criteria

- Lower credit risk with continuous model learning

- Ensure full auditability for regulatory reviews

How It Works

- Connect to credit bureau APIs and CRM systems.

- Upload applicant documents and transaction data.

- AI extracts details and evaluates the eligibility score.

- Results are reviewed and pushed into loan management systems.

Add-ons & Integrations

- Credit Bureaus: CIBIL, Experian, CRIF

- Core Systems: FinnOne, Oracle Financials, Mambu

- APIs: REST for custom FinTech platforms

Deployment & Access

- SaaS or hybrid model

- Configurable scoring templates

- Role-based dashboards for underwriters and risk managers

What Our Partners Are Saying

Frequently Asked Questions

Can it read bank statements and PDFs automatically?

Yes. It uses OCR + NLP to extract relevant data fields.

Does it support credit bureau integration?

Yes. CIBIL, Experian, and other bureau APIs can be connected.

How customizable is the scoring model?

Fully customizable to match your lending policies.

Does it provide explainable AI results?

Yes. Every score includes factor-based justifications.

Can it be integrated with our LMS or CRM?

Yes. It supports easy API integration for seamless automation.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started