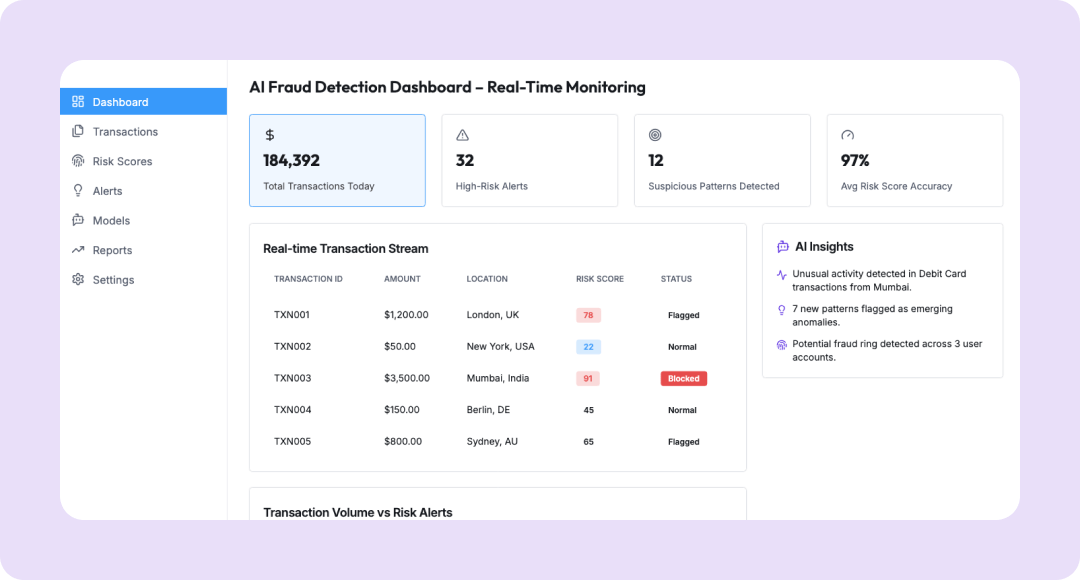

AI Fraud Detection & Risk Scoring Workflow

Detect Financial Fraud and Assess Transaction Risk in Real Time

Use Kriatix’s AI engine to monitor transactions, flag anomalies, and assign risk scores to prevent fraudulent activities before they occur.

See AI Fraud Detection & Risk Scoring Workflow In Action

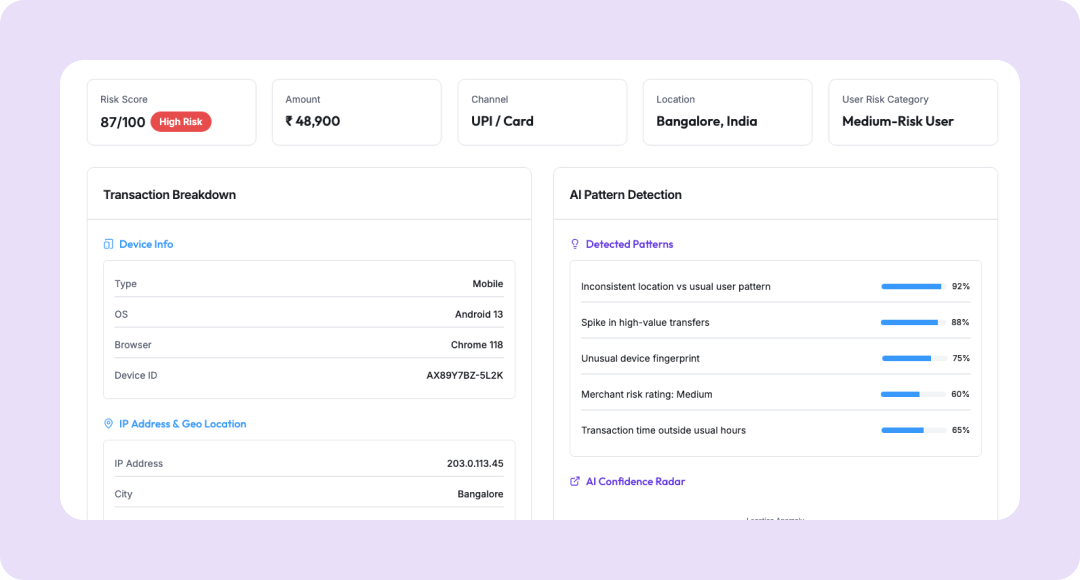

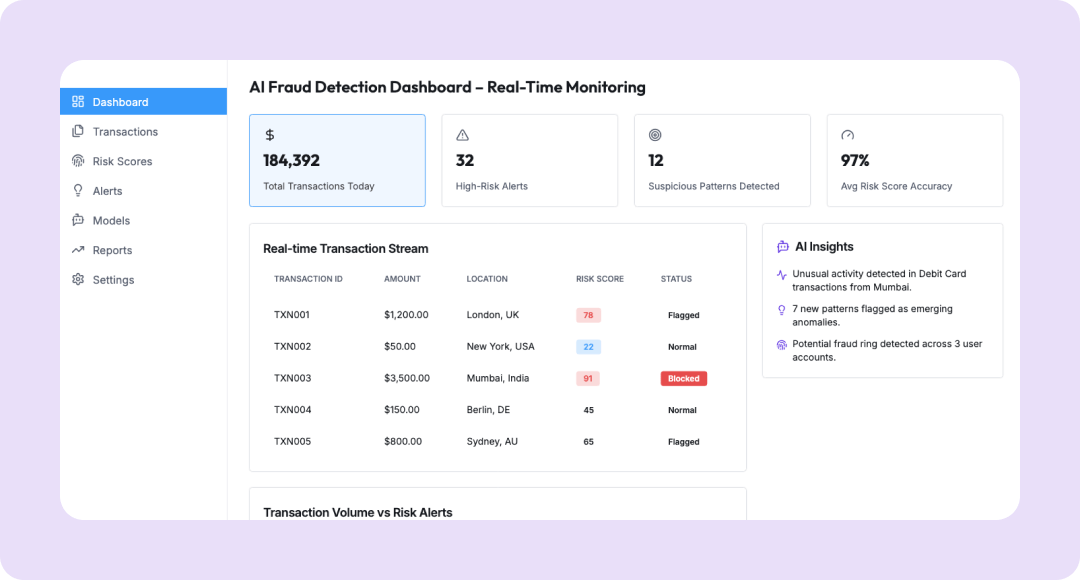

The AI Fraud Detection & Risk Scoring Workflow continuously monitors customer transactions and behavioral data to identify patterns of potential fraud. It analyzes parameters like transaction velocity, geolocation, device data, and account behavior to assign a real-time risk score for each activity. This allows fintech companies and banks to prevent suspicious actions, reduce chargebacks, and ensure compliance with AML (Anti-Money Laundering) standards.

🔹 AI-powered real-time fraud detection

🔹 Risk scoring based on transaction behavior

🔹 Integrates seamlessly with payment gateways and banking APIs

What Is the AI Fraud Detection & Risk Scoring Workflow?

This workflow combines anomaly detection, behavioral analytics, and machine learning to proactively identify fraudulent transactions.It compares each event against customer historical data and global fraud patterns.

Alerts are generated with a confidence score, enabling teams to investigate or block risky actions instantly.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Risk Analysts | Identify fraudulent transactions automatically |

| Compliance Officers | Maintain AML and KYC compliance with real-time alerts |

| Payment Gateways | Reduce chargebacks and fraudulent transactions |

| CFOs / FinTech Leaders | Gain visibility into risk exposure |

| Developers/Product Teams | Embed AI-based risk scoring into existing payment flows |

Key Features

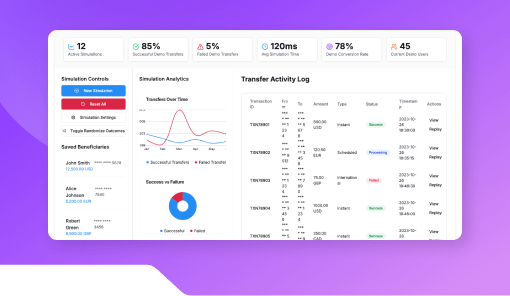

- Anomaly Detection Engine: Detects suspicious behavior using machine learning models.

- Risk Scoring Model: Assigns confidence-based risk scores to every transaction.

- Alert Dashboard: Provides real-time fraud detection and case management.

- Data Correlation Engine: Analyzes cross-account or cross-device patterns.

Benefits

- Detect fraud within milliseconds of occurrence

- Reduce financial losses and false positives

- Strengthen AML/KYC compliance

- Automate risk evaluation without human intervention

- Integrate AI directly into transaction pipelines

How It Works

- Connect payment or transaction APIs to the Kriatix Risk Engine.

- Import historical transaction and customer data for training.

- Set up risk thresholds and alert configurations.

- Start real-time scoring with dashboard monitoring.

Add-ons & Integrations

- Payment Systems: Razorpay, Stripe, PayU, Cashfree

- Banking APIs: NPCI, UPI, VISA, Mastercard

- Analytics Tools: Power BI, Splunk, Elastic

Deployment & Access

- On-premise or cloud-based deployment

- Admin and compliance dashboards

- Role-based access and audit trails

What Our Partners Are Saying

Frequently Asked Questions

Can it detect new types of fraud?

Yes. The AI model learns continuously from new data and behaviors.

Is it suitable for small fintechs?

Yes. It scales dynamically with transaction volume.

How fast are alerts generated?

Typically within 1–3 seconds of event detection.

Can it integrate with existing fraud systems?

Yes. It can act as an intelligence layer or standalone module.

Is it regulatory compliant?

Yes. Designed to align with AML, PCI-DSS, and RBI guidelines.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started