Auto Reconciliation Tool

Match Payments, Orders, and Transactions Automatically

Eliminate manual reconciliation errors with AI-driven automation that matches payments, invoices, and account entries in real time with Kriatix’s Auto-Reconciliation Tool.

See Auto Reconciliation Tool In Action

The Auto-Reconciliation Tool by Kriatix automates the time-consuming task of matching financial transactions across bank statements, orders, invoices, and accounting entries.

Using rule-based and AI-driven matching, it identifies missing records, mismatches, and unposted items instantly. This ensures faster month-end closings, accurate reporting, and reduced dependency on manual checks.

🔹 Match payments, invoices, and statements automatically

🔹 Reduce reconciliation time from hours to minutes

🔹 Improve financial accuracy and audit readiness

What Is the Auto-Reconciliation Tool?

The Auto-Reconciliation Tool automates transaction matching across multiple systems using AI and fuzzy logic. It detects unmatched or delayed payments, mismatched invoices, and duplicate entries while maintaining a clear audit trail.Designed for finance teams, it drastically cuts reconciliation time and boosts confidence in financial reporting accuracy.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Finance Teams | Automate reconciliation across multiple accounts |

| CFOs | Ensure faster and more accurate financial closings |

| Controllers | Reduce manual workload and reconciliation errors |

| Auditors | Gain visibility into reconciliation logs and traceability |

| Operations Teams | Sync cash flow and payment data effortlessly |

Key Features

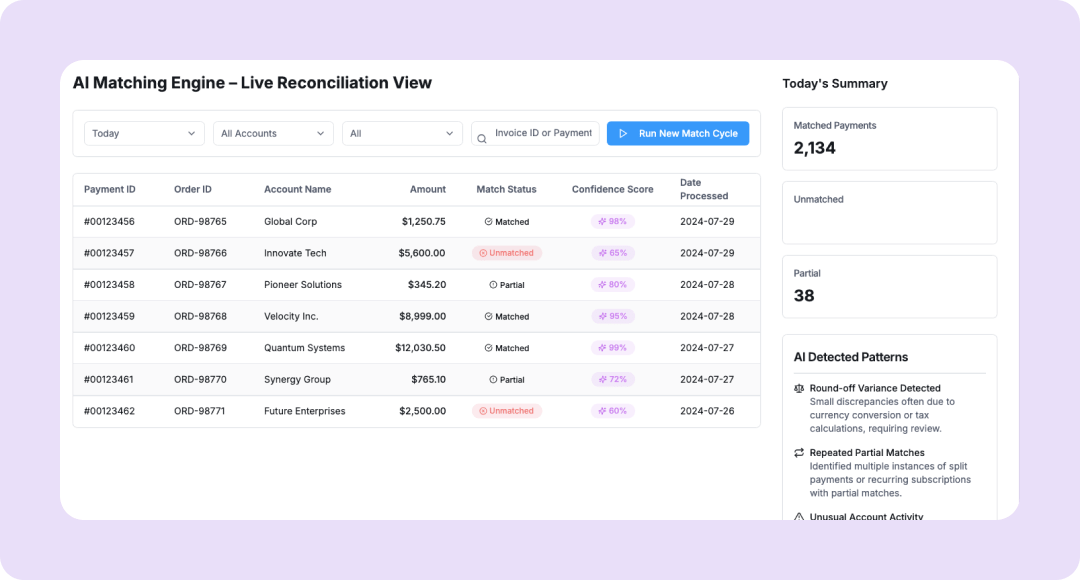

- AI-based matching of payments, invoices, and orders

- Configurable rules for multi-level reconciliation

- Fuzzy matching for partial or similar records

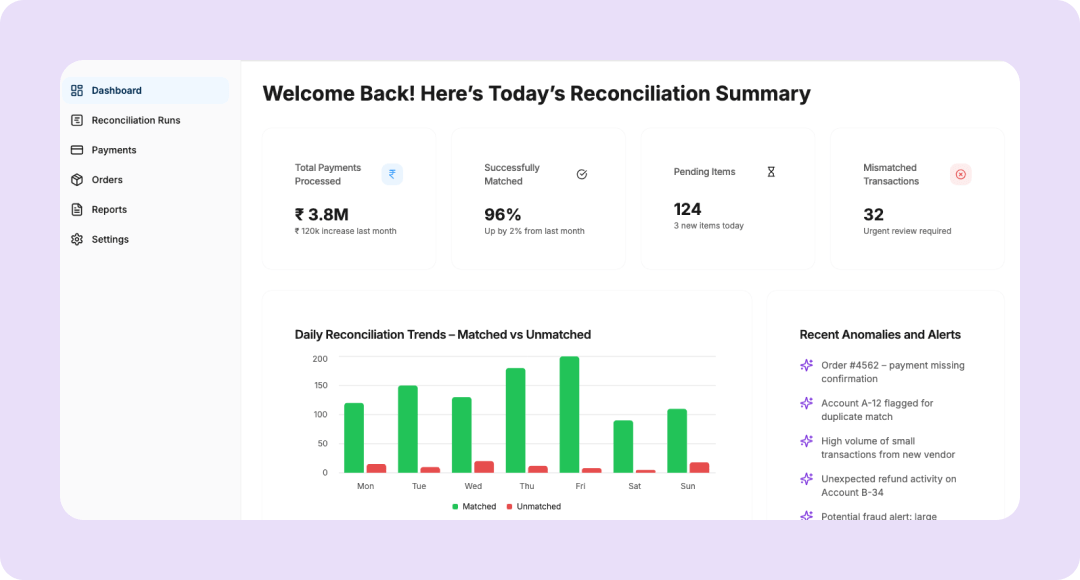

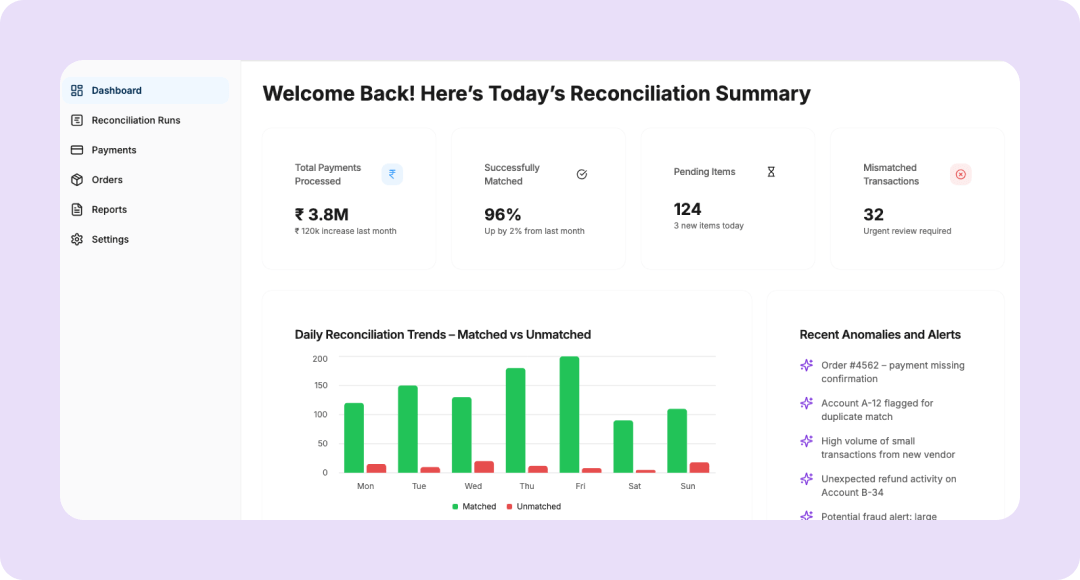

- Real-time dashboards with reconciliation summaries

- Exception and discrepancy reporting

- Integration with ERP and bank APIs

Benefits

- Save 70–90% of time spent on manual matching

- Reduce financial reporting errors

- Increase transparency and control over transactions

- Shorten reconciliation cycles dramatically

- Simplify audit trails and approvals

How It Works

Connect bank feeds, ERP, or accounting systems.

Define matching rules and tolerance thresholds.

AI performs real-time reconciliation and flags exceptions.

Review unresolved entries and export reconciliation reports.

Add-ons & Integrations

- Banking APIs: RazorpayX, HSBC, HDFC, ICICI

- ERP / Accounting: SAP, Oracle, Zoho Books, QuickBooks

- Analytics: Power BI, Tableau

Deployment & Access

- SaaS or hybrid model

- Role-based dashboards for finance teams

- Multi-ledger and multi-entity support

- SaaS or hybrid model

What Our Partners Are Saying

Frequently Asked Questions

1. How does AI match transactions?

It uses pattern recognition and fuzzy logic to compare entries across systems and match even slightly mismatched records.

2. Does it support multiple bank accounts?

Yes, it can handle multi-bank and multi-currency reconciliations.

3. Can we define our own rules?

Yes, administrators can customize rules and tolerances for specific departments or accounts.

4. Is the system audit-compliant?

Absolutely. Every match and exception is logged with a timestamp and user trail.

5. How does it improve month-end closing?

By automating matching and flagging discrepancies early, it speeds up reconciliation and final reporting cycles.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started